Switzerland and Morocco Lead the Way in Financial Innovation

As we approach the end of 2024, significant developments are unfolding in the financial markets of Switzerland and Morocco. In this update, we'll delve into the latest news from these markets, covering topics such as settlement cycles, digital assets, and market initiatives.

Switzerland: T+1 Progress and Digital Asset Leadership

In May 2024, following the successful migration of the USA, Canada, and Mexico markets to a T+1 equities settlement cycle, with affirmation rates exceeding 92%, SIX SIS successfully adjusted its systems to be able to settle cross border trades in these markets. While Switzerland has not yet implemented T+1, taskforces have been established to discuss the potential impacts of transitioning to this shorter settlement cycle.

Furthermore, Switzerland has emerged as a leader in digital asset development, with significant progress being made in this space, and SIX SIS has been one of the few financial market infrastructures that has made significant progress in digital asset custody via its Swiss Digital Exchange which incorporates a digital asset CSD.

Regarding the custodian bank market, the RC discussed the impact of Credit Suisse exiting as a provider and merging with UBS. Although the majority of clients migrated to UBS, interestingly, SIX and BNP Paribas have also been able to increase market share since the acquisition, as some clients chose other providers. The Swiss market remains stable despite recent developments involving Credit Suisse and UBS.

Morocco: Focusing on Market Initiatives

In Morocco, market infrastructures have advised that there are no current plans to shorten the settlement cycle from T+2 to T+1, as this is not being pushed for by market participants. However, the Autorité Marocaine du Marché des Capitaux (AMMC) is studying the potential impact of shortening the settlement cycle.

Instead, the Moroccan market is focused on other initiatives, such as stabilising Securities Lending and Borrowing (SLB), establishing a Central Counterparty (CCP), and introducing derivatives markets. The Casablanca Stock Exchange is working on two main projects: introducing derivatives markets and a CCP by year-end 2024.

Regulatory bodies in Morocco, including the AMMC, Bank Al-Maghrib (BAM), and the Ministry of Finance & Economy, are also discussing digital assets. Drafting a law to define digital assets is underway, with input from regulators across the globe.

Additionally, cyber security regulations have been implemented by the Direction Generale De La Securite Des Systemes D'Information (DGSSI). These regulations aim to enhance security in Morocco's financial markets.

As 2024 draws to a close, Switzerland and Morocco are driving innovation in their respective financial markets. With developments like T+1 progress, digital asset leadership, and market initiatives, these countries are setting the stage for future growth and stability in the global financial landscape.

A Month of Elections Across the Globe

November 5th saw a surprise landslide victory for former US President, Donald Trump, as well as the Republican party taking control in the Senate r as American voters turned out in strength. Republicans also took the Senate and together with the majority in the House of Representatives, all branches of the US government are now under Republican control.

On November 5th, Puerto Rico is also holding elections that will be historic regardless of which of the top two gubernatorial candidates wins. The two parties that have dominated Puerto Rican politics for decades are losing their grip as they face the stiffest competition yet from a younger generation hungry for change.

The government of Mauritius on Friday banned access to social media websites ahead of parliamentary elections on November 10th in which Prime Minister Pravind Jugnauth is seeking a second term in power.

Local elections are also running full steam ahead, with council elections in Kyrgyzstan set to take place on November 17th, marking a date to circle on the calendar.

The Chamber of Deputies, Romania's lower legislative chamber, has approved a draft bill to hold a local referendum in Bucharest on the same day as the first round of the presidential election. This means both events will take place on November 24th in the same polling stations, reducing the costs of organizing the public consultation and minimizing voters' time at the polls.

Capital Markets – All Eyes on the US

In the US, macrodynamic tailwinds are driving stocks higher and may sustain elevated valuations until earnings align. Among investment options, small-cap stocks and value stocks appear particularly attractive, while the energy sector shows promising risk/reward potential.

US shares and Bitcoin reached record highs after the Trump victory as investors anticipated more sympathetic business and crypto policies as well as lower taxes, but higher inflation and interest rates. Bank stocks hit a 2-year high and small-cap stocks hit a 3-year high.

Asian and European stocks closed down on the Trump threat of import tariffs, the DAX hit hardest with the US representing the biggest market for German carmakers.

Risk Committee Updates

Stay informed with Thomas Murray for the latest on market dynamics and regulatory trends – subscribe to Risk Committee Updates on LinkedIn.

We safeguard clients and their communities

Petroleum Development Oman Pension Fund

“Thomas Murray has been a very valuable partner in the selection process of our new custodian for Petroleum Development Oman Pension Fund.”

ATHEX

"Thomas Murray now plays a key role in helping us to detect and remediate issues in our security posture, and to quantify ATHEX's security performance to our directors and customers."

Northern Trust

“Thomas Murray provides Northern Trust with a range of RFP products, services and technology, delivering an efficient and cost-effective solution that frees our network managers up to focus on higher Value activities.”

Insights

Why 72 hours is the New Standard for M&A Cyber Due Diligence

A decade ago, cyber due diligence sat somewhere between “nice to have” and “we’ll deal with it post-close.” That world no longer exists.

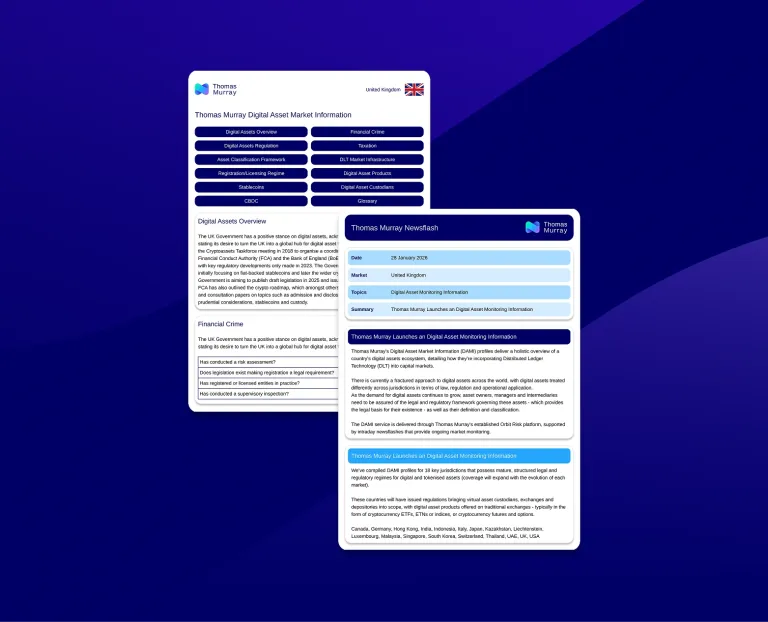

Thomas Murray Launches Digital Asset Market Information (DAMI)

Thomas Murray, a global leader in risk management, due diligence, and cybersecurity services, is proud to announce the launch of Digital Asset Market Information (DAMI).

Solving the "Scale Paradox": How to Automate Portfolio Oversight with Fewer People

In 2026, private equity technical teams are facing a "Scale Paradox": portfolios are growing in complexity, while in the internal teams responsible for operations and cybersecurity oversight, headcounts remain stagnant.

How Private Equity Hackers Choose Their Targets

Private equity firms sit at the intersection of high-value financial transactions, sensitive deal data, and an expanding portfolio of technology heavy portfolio companies – and it’s this combination that makes PE an attractive target for cyberthreat actors.