High-quality, real-time data

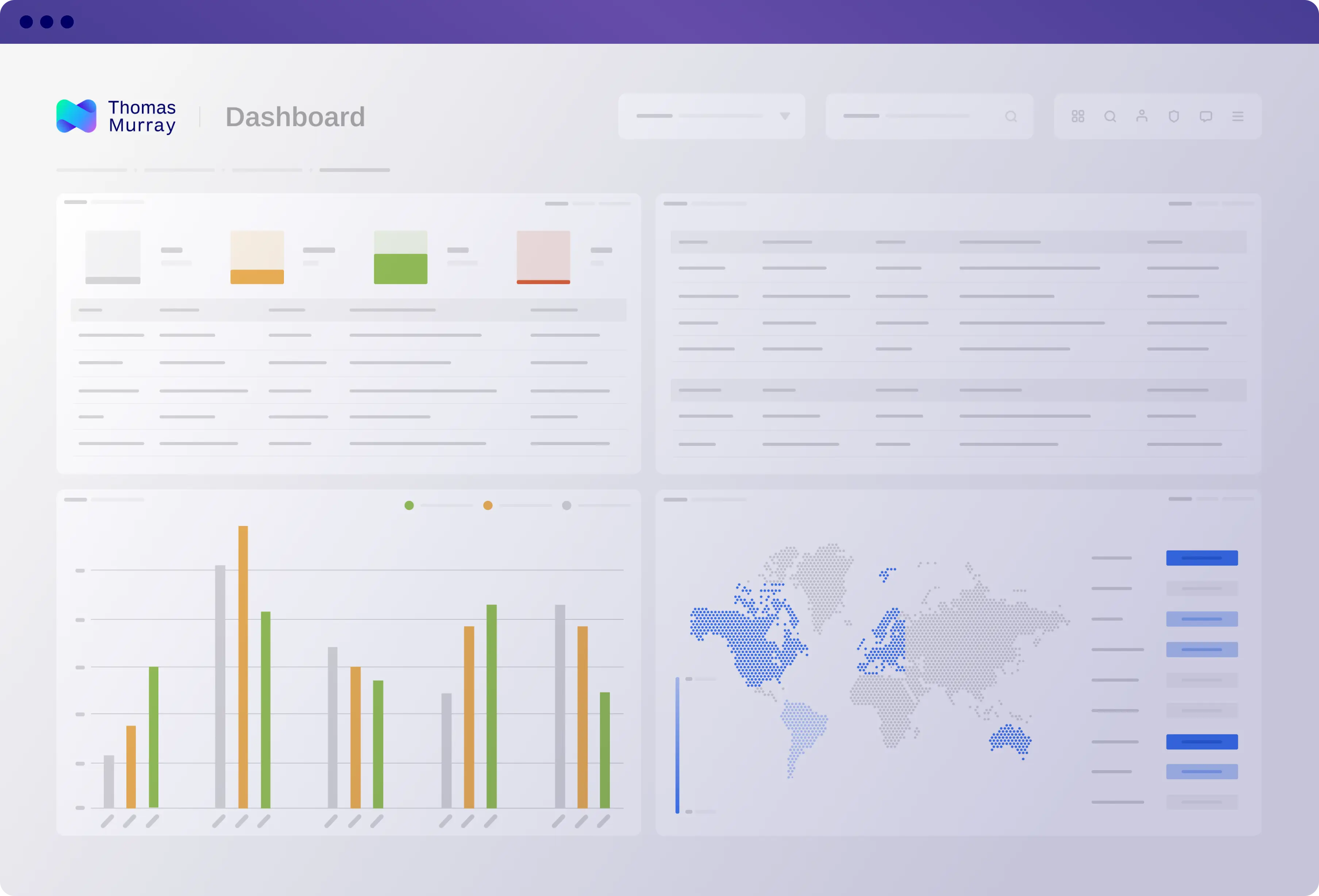

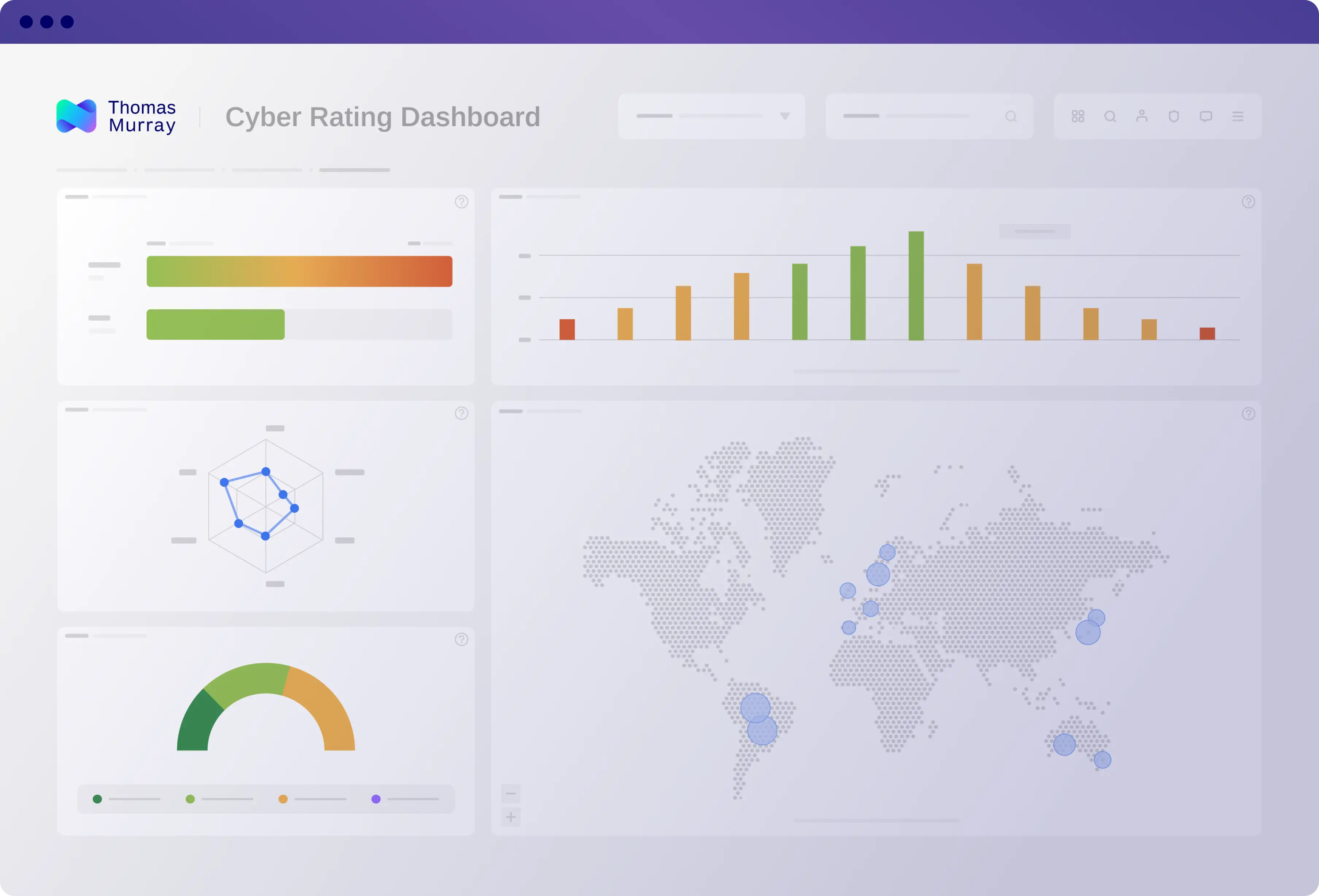

Orbit RiskOur automated Orbit Risk platform and managed services team delivers:

- Questionnaire-based, red-amber-green (RAG) assessments.

- Proprietary cyber risk evaluations.

- Curated news feeds and alerts for in-scope entities.

- Analysis of fund and fund manager financial statements.

- Entity-level profiles, showing engagement, assessment results and next actions.

Learn more

Our automated Orbit Risk platform and managed services team delivers:

- Questionnaire-based, red-amber-green (RAG) assessments.

- Proprietary cyber risk evaluations.

- Curated news feeds and alerts for in-scope entities.

- Analysis of fund and fund manager financial statements.

- Entity-level profiles, showing engagement, assessment results and next actions.

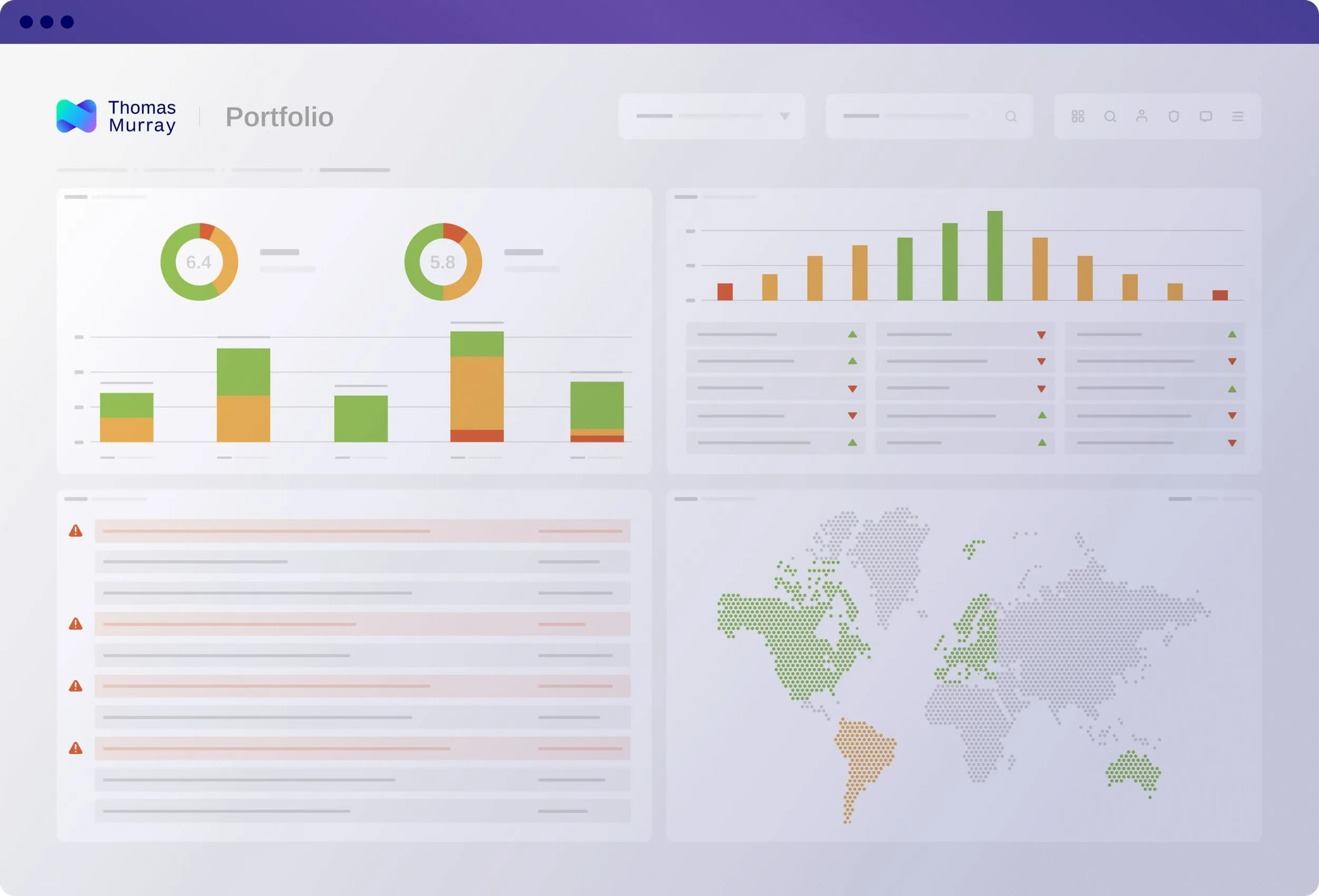

Orbit Diligence Orbit Diligence is a simple, centralised due diligence hub.

- Access a full database of managers, funds, direct investments and other counterparties.

- A secure document depository.

- Real-time, collaborative communication for stakeholders.

- Automated, and flexible functionality for DDQs and RFIs.

- Analyse and prioritise risk.

- Intuitive vendor management (for onboarding/offboarding and RFPs).

- Manage and resolve issues with counterparties efficiently.

Learn more

Orbit Diligence is a simple, centralised due diligence hub.

- Access a full database of managers, funds, direct investments and other counterparties.

- A secure document depository.

- Real-time, collaborative communication for stakeholders.

- Automated, and flexible functionality for DDQs and RFIs.

- Analyse and prioritise risk.

- Intuitive vendor management (for onboarding/offboarding and RFPs).

- Manage and resolve issues with counterparties efficiently.

Orbit SecurityOrbit Security addresses increasing supply chain risk, allowing you to monitor both your own cybersecurity posture and that of your third parties.

- Continuously monitor third parties with automated security ratings, questionnaires and proactive escalation of issues.

- Set alerts to see when your critical service providers are exposed.

- Grant access to their IT security teams, allowing them to engage with assessment and improve their score.

- Generate regular reporting for your board, regulators and other stakeholders to demonstrate thorough, proactive oversight.

Learn more

Orbit Security addresses increasing supply chain risk, allowing you to monitor both your own cybersecurity posture and that of your third parties.

- Continuously monitor third parties with automated security ratings, questionnaires and proactive escalation of issues.

- Set alerts to see when your critical service providers are exposed.

- Grant access to their IT security teams, allowing them to engage with assessment and improve their score.

- Generate regular reporting for your board, regulators and other stakeholders to demonstrate thorough, proactive oversight.

Enhanced operational due diligence

Centralised data

Get instant access to all your data, optimising due diligence outcomes.

- Real-time tracking of completion rates and projects.

- Standardised evaluation with greater control over your data.

- Teams can communicate in-platform.

Automated, flexible workflows

Streamline your DDQ, RFI and RFP processes.

- Access a library of industry-standard and customisable questionnaires, or add your own.

- Keep up with regulatory changes and identify new risks.

- Use ongoing monitoring and question tags to mark items for further review or action.

Efficient and cost-effective

Automated due diligence processes and centralised data management increase efficiency, reduce errors and save money.

- Faster, more accurate reporting and decision-making.

- Better control over your data environment.

- Accurate and clear reporting to decision-makers.

- Rapid progress on mission-critical projects.

Find out more

Our experts

Insights

Operational Due Diligence in Australia: Meet APRA Standard CPS 230

Coming into effect on 1 July 2025, this standard aims to ensure that APRA-regulated firms can effectively manage and mitigate operational risks.

Operational Due Diligence and Regulations in Canada

As regulators continue to strengthen their focus on operational risk management, Operational Due Diligence (ODD) has become crucial for Canadian funds

Central Bank of Ireland: UCITS Permitted Markets Regulation

The Central Bank of Ireland UCITS Permitted Markets Regulation relates to the eligibility criteria for markets into which UCITS funds can invest.

The essential role of fund administrators in investment funds

Fund administrators are specialised service providers that handle the administrative and operational aspects of investment funds.