Our Clients

Our Solutions

For Banks

Monitor risks across your global banking operations with our tailored solutions

For Asset Owners

Select, monitor and benchmark your custodians, while monitoring your direct and outsourced investments with our tailored managed service

For FMIs & Regulators

While planning and executing risks and regulatory assessments, we support your navigation of complex, transformative capital markets

Manage risk, achieve compliance and tighten security with Orbit Risk

An industry-leading solution for banks, investors, and corporates looking to monitor markets, track operational risks and identify security issues before they are exploited.

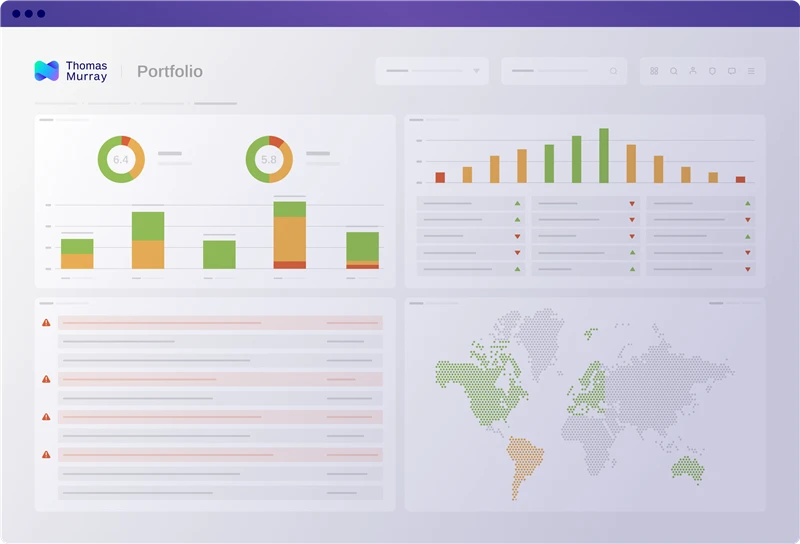

Orbit Intelligence captures your risk landscape with insights from across the platform. It centralises risk analysis, data, and news on your portfolio of monitored organisations.

- My portfolio risk dashboard

- Enhanced risk view

- Structured data profiles

Automate your due diligence questionnaires (DDQ) and request for information (RFI) processes for a wide range of use cases. Access a library of off-the-shelf questionnaires and risk frameworks, and free up valuable resources.

- Manage questionnaires efficiently

- Identify risks

- Improve communications

Orbit Security Ratings are an automated, powerful way to continuously monitor the cyber security posture of your organisation and the third parties it relies on, with data-driven analytics so you can enhance the security of your ecosystem.

- Quantify cyber risk

- See what hackers see

- Sector-by-sector benchmarking

Orbit Intelligence

Monitor global third-party risk, with real-time threat monitoring, newsflashes and critical alerts.

Protect and inform with Orbit Risk

Get comprehensive AI-powered risk assessment and due diligence, advanced analytics, and mitigation strategies.

Orbit Security

Automate your third-party risk management, with risk scores, optimised cybersecurity, and compliance.

For comprehensive Cyber Risk solutions, visit Thomas Murray Cyber

Discover how we can support you

We safeguard clients and their communities

Insights

Operational Due Diligence: A Playbook for Asset Owners and Allocators

Navigate the evolving ODD landscape, with industry insights that will help you to identify, assess, and monitor emerging risks.

Thomas Murray Risk Update: Middle East Developments – Impact on Post-Trade and Capital Markets

Thomas Murray’s Risk Committee (RC) met today to assess the rapidly evolving geopolitical situation in the Middle East.

Why 72 hours is the New Standard for M&A Cyber Due Diligence

A decade ago, cyber due diligence sat somewhere between “nice to have” and “we’ll deal with it post-close.” That world no longer exists.

Thomas Murray Launches Digital Asset Market Information (DAMI)

Thomas Murray, a global leader in risk management, due diligence, and cybersecurity services, is proud to announce the launch of Digital Asset Market Information (DAMI).