The future of digital custody oversight

Our Digital Asset Custodian Monitoring (DACM) product sets the standard for transparency and risk intelligence in digital markets.

Whether you're an institutional investor, asset manager, financial institution, or infrastructure provider, safeguarding digital holdings demands rigorous oversight across the entire value chain, including wallet providers, data centres, and cloud infrastructure.

Backed by years of Thomas Murray experience in global risk oversight and post-trade infrastructure, DACM comprehensively supports the real-time monitoring of digital custodians and their third party dependencies.

Through our Orbit Risk platform, you can assess:

- Operational resilience

- Cybersecurity posture

- Legal and regulatory compliance

- Financial stability

For institutions requiring additional support, we offer DACM as a fully managed service, delivering expert-led due diligence, customised analysis, and continuous enhancement of your digital custody strategy.

Our market coverage and monitoring expertise

40+

15+

330+

700+

20

1,500+

11

Orbit Risk

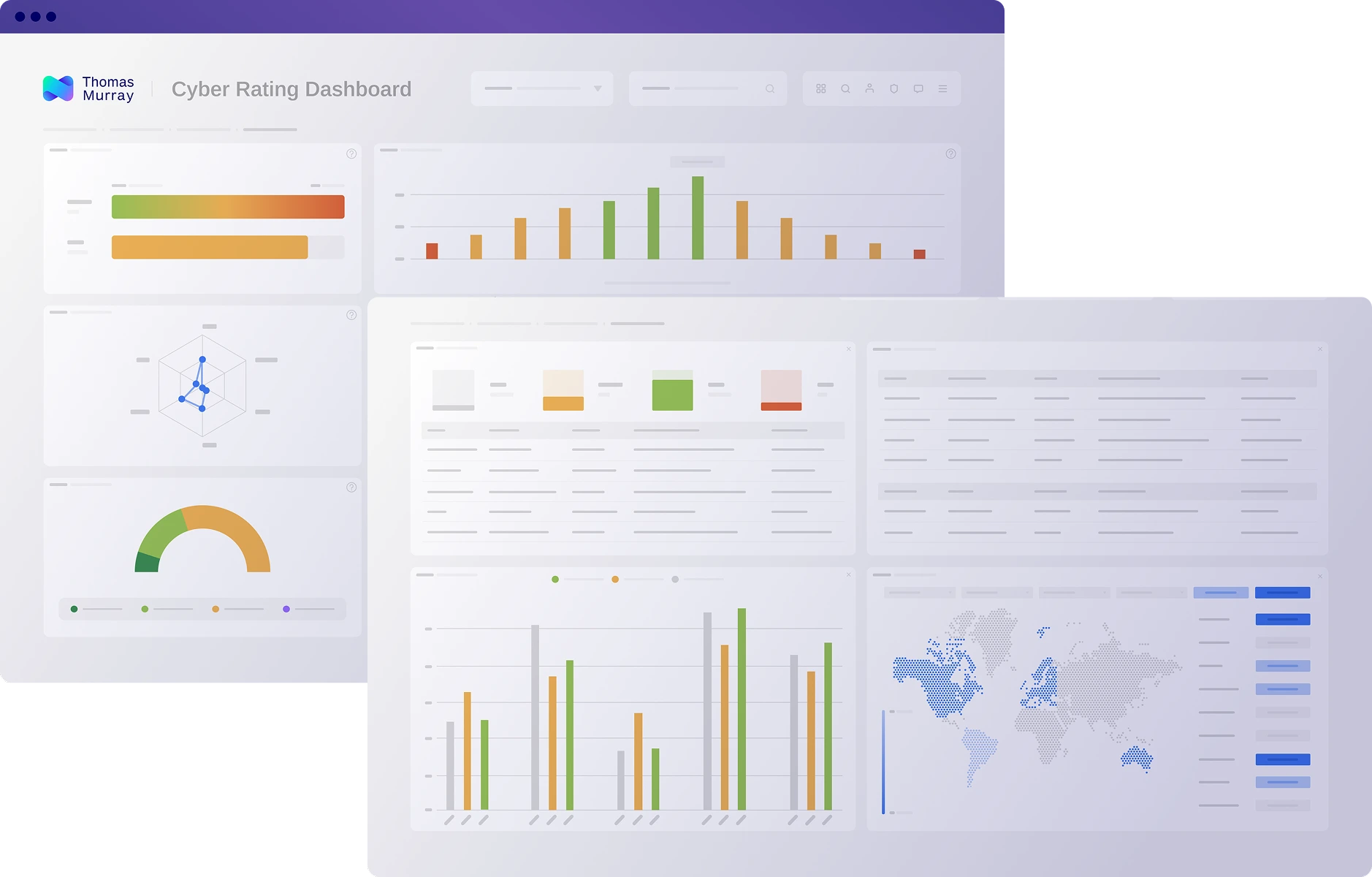

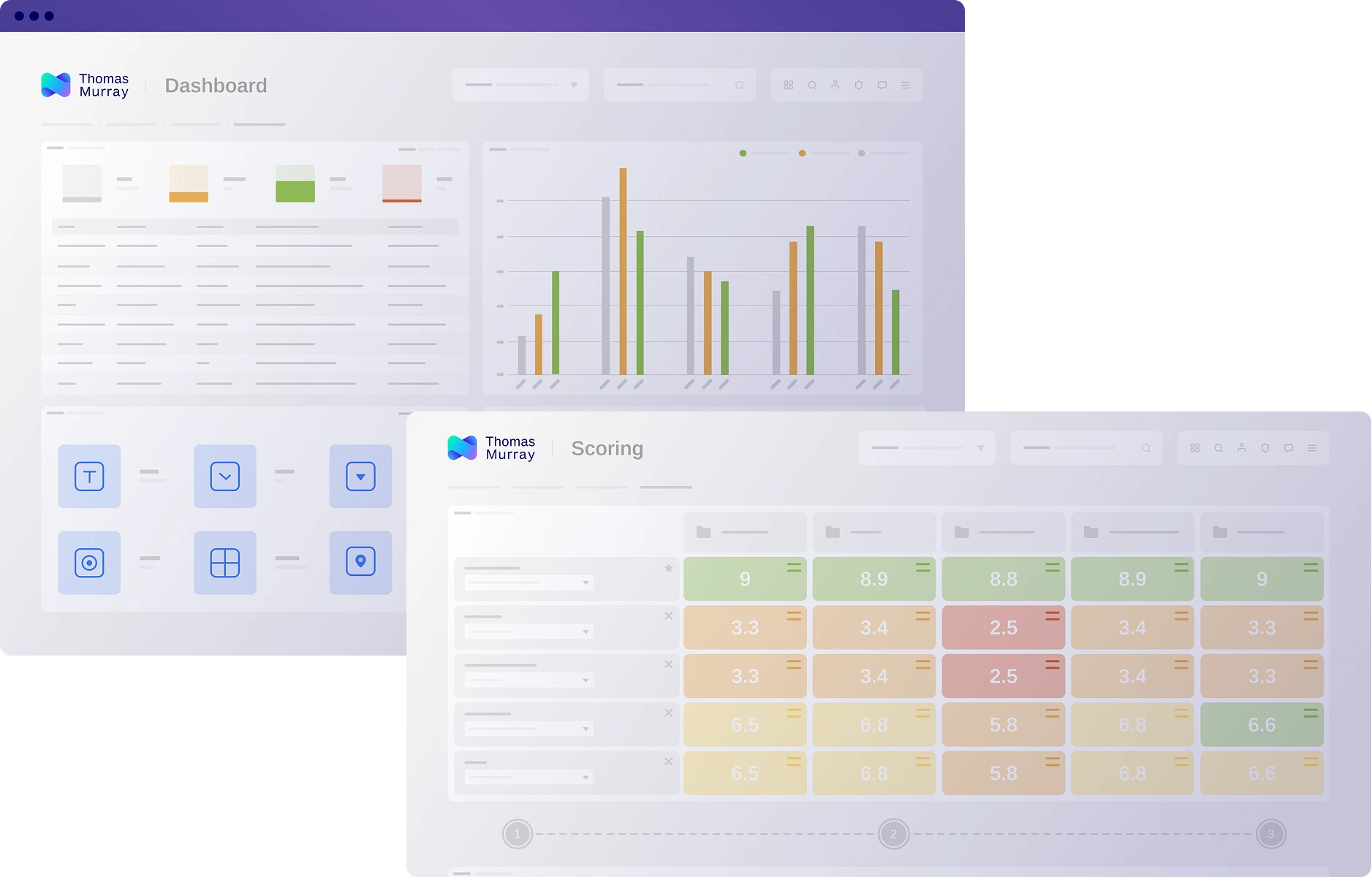

Through Orbit Risk, institutional investors and financial institutions gain access to a powerful suite of tools designed to enhance transparency, security, and operational resilience.

My Portfolio users can clearly visualise their entire network of custodians, wallets, and counterparties within a single, unified dashboard, while detailed Entity Profiles allow users to dive deeper into the risk metrics for each custodian, offering critical insights into:

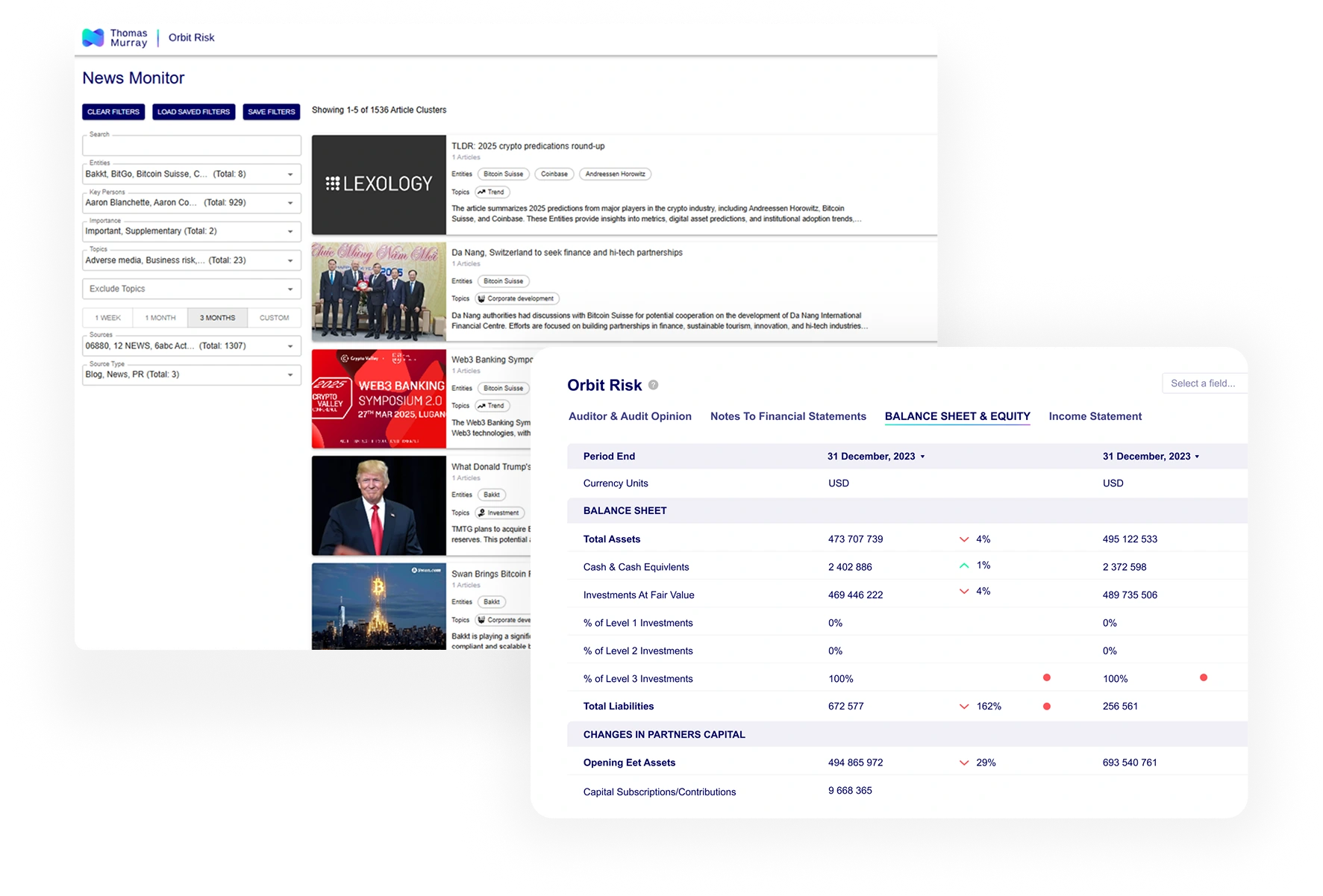

Cybersecurity (via Orbit Security)- Tracks the cyber risks associated with all digital asset custodians and associated counterparties.

- Track exposure across technology groups, data centres, vaults, exchanges, brokers, clearers and more.

- Tracks the cyber risks associated with all digital asset custodians and associated counterparties.

- Track exposure across technology groups, data centres, vaults, exchanges, brokers, clearers and more.

Due diligence management (via Orbit Diligence)- Issue, manage, and benchmark structured due diligence questionnaires.

- Review responses using standardised methodologies.

- Generate risk-adjusted evaluations and peer comparisons.

- Issue, manage, and benchmark structured due diligence questionnaires.

- Review responses using standardised methodologies.

- Generate risk-adjusted evaluations and peer comparisons.

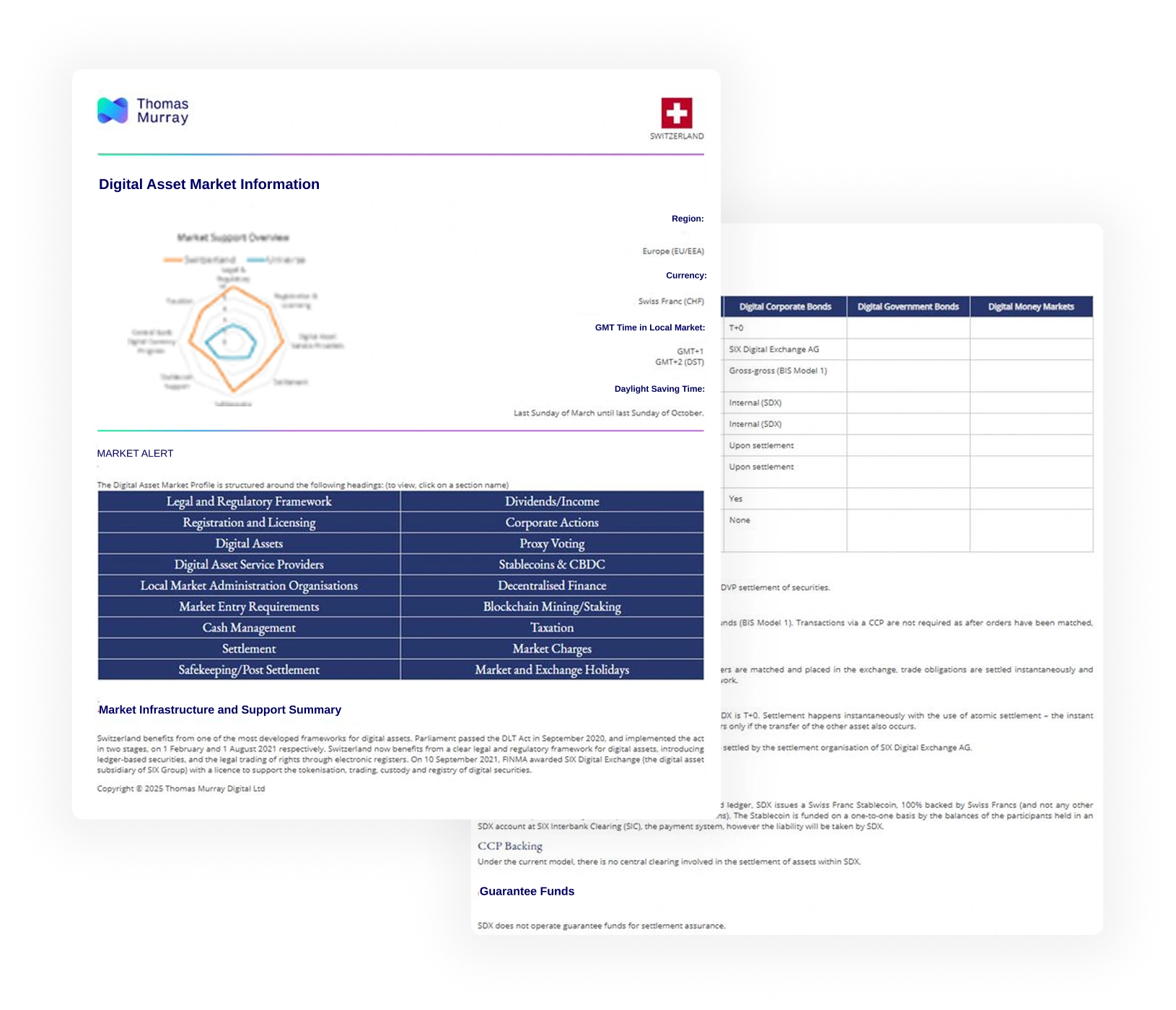

Market information (via Orbit Intelligence)- Detailed market-by-market analysis of how digital assets are regulated.

- Covers legal and regulatory regimes, settlement processes, stablecoins, CBDCs, taxation and more.

- Enables jurisdictional risk analysis and strategic positioning.

- Detailed market-by-market analysis of how digital assets are regulated.

- Covers legal and regulatory regimes, settlement processes, stablecoins, CBDCs, taxation and more.

- Enables jurisdictional risk analysis and strategic positioning.

Ongoing monitoringGet real-time updates on changes to provider profiles, financial standing, and cybersecurity posture (includes media scanning, market newsflashes, and regulatory updates).

Get real-time updates on changes to provider profiles, financial standing, and cybersecurity posture (includes media scanning, market newsflashes, and regulatory updates).

DACM benefits

For digital asset owners

Risk-based custodian selection: Choose providers based on robust, comparative risk analysis. Continuous oversight: Monitor custodians on an ongoing basis, across security, operational, financial, and regulatory domains. Proactive risk alerts: Stay ahead of developments that impact asset safety or servicing continuity. Strategic leadership: Lead the adoption of standardised risk governance in digital asset management.

For financial institutions

Institutional collaboration: Contribute to and benefit from a peer-driven framework for digital custody standards. Digital strategy enablement: Align with best-in-class custodians to execute your digital asset and Web3 ambitions. Market credibility: Leverage Thomas Murray’s reputation to enhance stakeholder confidence and regulatory alignment. Comparative benchmarking: Access standardised assessments to evaluate and improve internal and external custody operations. Regulatory readiness: Be prepared for increased global regulatory scrutiny with a methodology that anticipates compliance needs.

Addressing the biggest digital asset custodian risks

Leveraging our industry-leading risk categorisation methodology, we address the operational risk elements that are critical to the effective safeguarding of digital assets. In addition to traditional operational risk elements, these include:

Cybersecurity

The risk of a breach, leading to the loss or theft of client assets which can result in significant reputational damage, financial difficulties, and potential regulatory penalties.

Key areas to address include:

- Vulnerability assessments and penetration testing.

- Third party risk.

- Incident response plans.

- Ongoing monitoring (Orbit Security).

Asset Safety

The risk of asset loss due to breakdowns in safekeeping practices and related security controls.

Key areas to address include:

- Legal and regulatory compliance.

- Key policy and management.

- Secure architecture.

- Wallet and account structures.

Asset Servicing

The risk that a provider may be limited in its ability to effectively service digital assets, leading to potential losses or missed opportunities.

Key areas to address include:

- Events policy and support.

- Staking and DeFi.

- Token event processing.

- Blockchain governance.

Operational Risk

The risk of client loss due to breakdowns or weaknesses in a digital custodian's controls or procedural framework.

Key areas to address include:

- Financial crime policies and tools.

- FATF travel rule compliance.

- Operational resilience/BC/DR.

- Audit.

- Protection against bad actors.

Financial Risk

The risk that a digital custodian has insufficient financial resources to withstand operating pressures or a sustained cyberattack on its business. Key areas to address include:

- Insurance: ensure appropriate insurance policies exist that address digital asset-specific risks, including loss of keys and cybercrime.

- Enhanced financial analysis: examination of the custodian’s balance sheet backing, key ratios, and solvency.

- Blockchain proofs (where applicable): solvency/reserves/assets/liabilities.

Find out more

If you'd like to find how we can support your digital assets provider selection, risk evaluation, monitoring, and strategy execution, please speak to one of our experts.

Our experts