Managing the risk of cash correspondent banking

Correspondent banks are authorised to provide services on behalf of other banks. They are especially important to frontier and emerging markets because they allow domestic banks to access international markets. However, anti-money laundering and combatting the financing of terrorism (AML/CFT) policies alone are not enough to protect the stability of the world's markets and the integrity of correspondent banking services.

That's why Cash Correspondent Monitoring (CCM) is essential for all stakeholders in the financial ecosystem. It helps to prevent illicit activities and ensure compliance with regulatory standards. It provides valuable oversight and risk management capabilities, critical for maintaining the security of the global financial system. The need for robust CCM is therefore driven by a combination of long-term regulatory, risk and operational requirements.

A standardised, holistic approach to cash correspondent monitoring

Thomas Murray, in partnership with more than 25 banks around the world, has created a standardised approach to Cash Correspondent Monitoring.

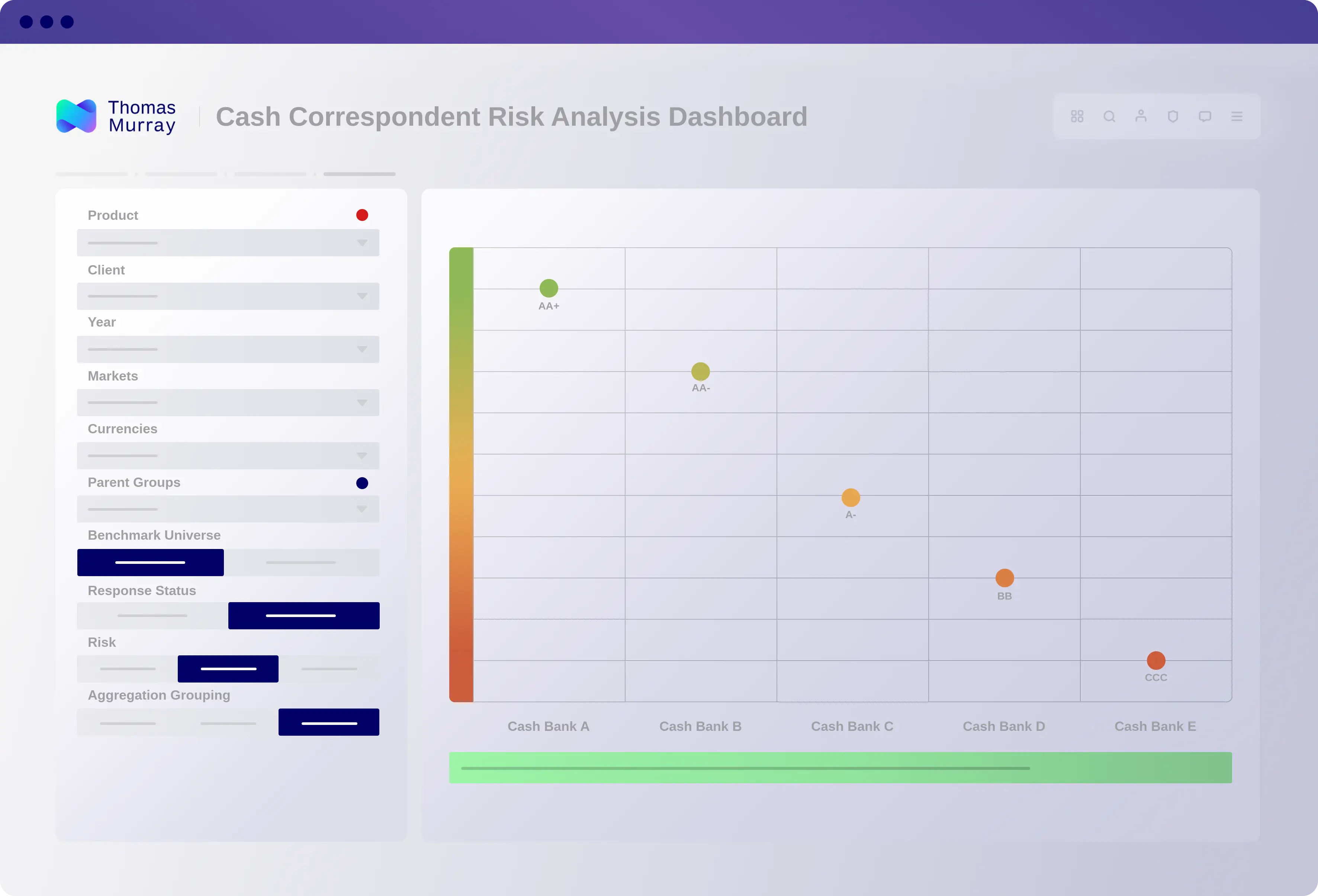

Our managed service solution is built around an industry-agreed, closed-end questionnaire that agent banks complete, with a focus on financial and operational risks. The results are benchmarked by market, region, and currency to give banks global, regional, and local insight into their agent bank networks, and how their providers compare to local competitors.

Traditional AML or counter-terrorism financing (CTF) tools often focus on individual transactions or customer profiles. In contrast, correspondent monitoring adopts a holistic approach by considering the entire banking relationship between institutions. This allows for a more comprehensive understanding of the potential risks and vulnerabilities associated with each correspondent bank.

Benefits of Cash Correspondent Monitoring

Ensure regulatory compliance of your cash correspondence relationships

Receive up-to-date risk assessments of your cash bank relationships

Build and maintain strong relationships with partners

All responses are verified and validated

View comprehensive bank reporting and benchmark analytics by market and currency

Receive market intelligence updates through news flashes

Monitor ESG and cyber risks of cash correspondent entities

Increase efficiency of your resources

Our CCM solution works on two integrated modules:

Cash Correspondent Monitoring step-by-step

1. Using Orbit Diligence- Provide Thomas Murray with a list of cash correspondent banks that require monitoring.

- We will manage all the issuances, collection, verification, and validation of responses.

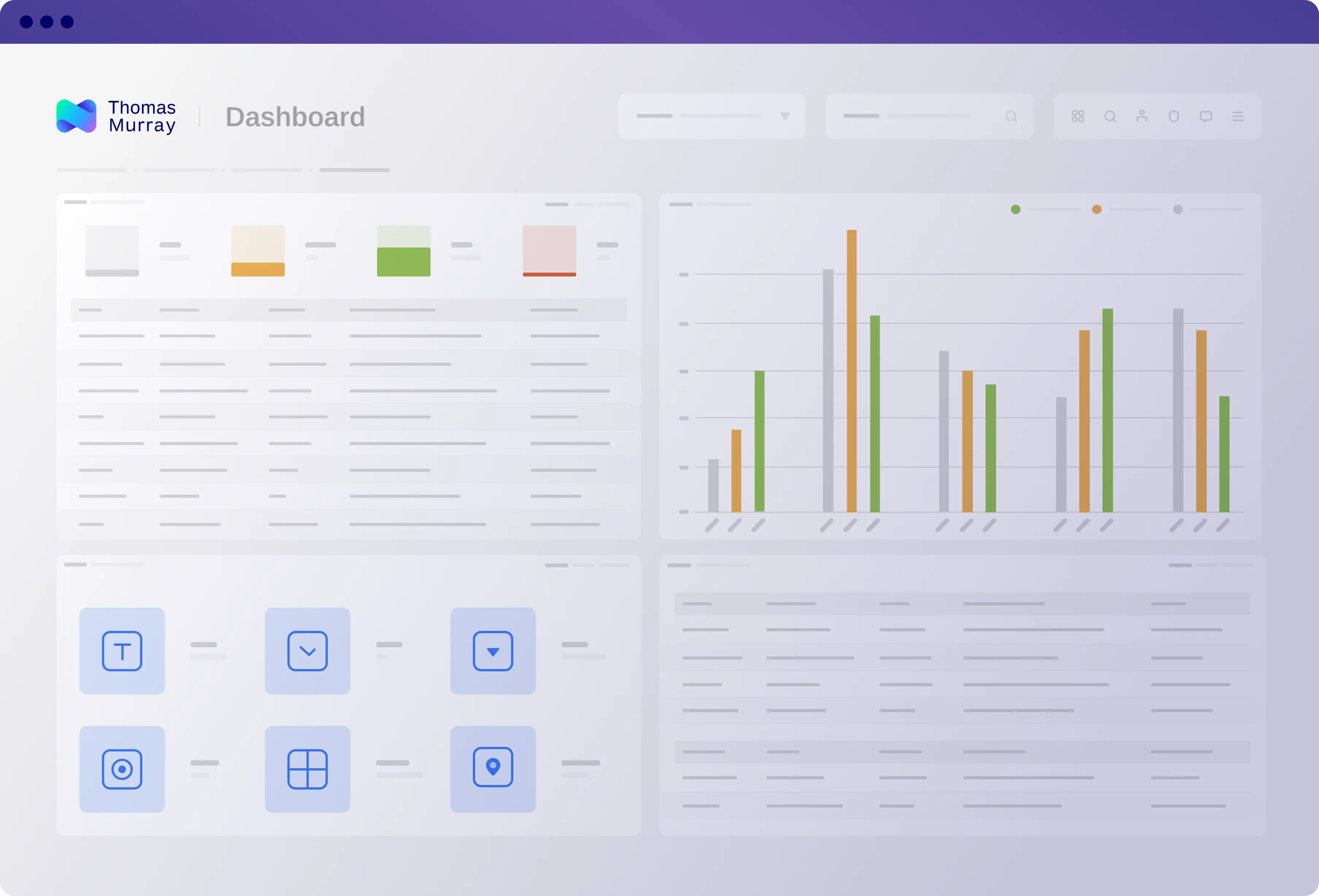

- You can access customisable dashboards for questionnaire status and responses.

- Provide Thomas Murray with a list of cash correspondent banks that require monitoring.

- We will manage all the issuances, collection, verification, and validation of responses.

- You can access customisable dashboards for questionnaire status and responses.

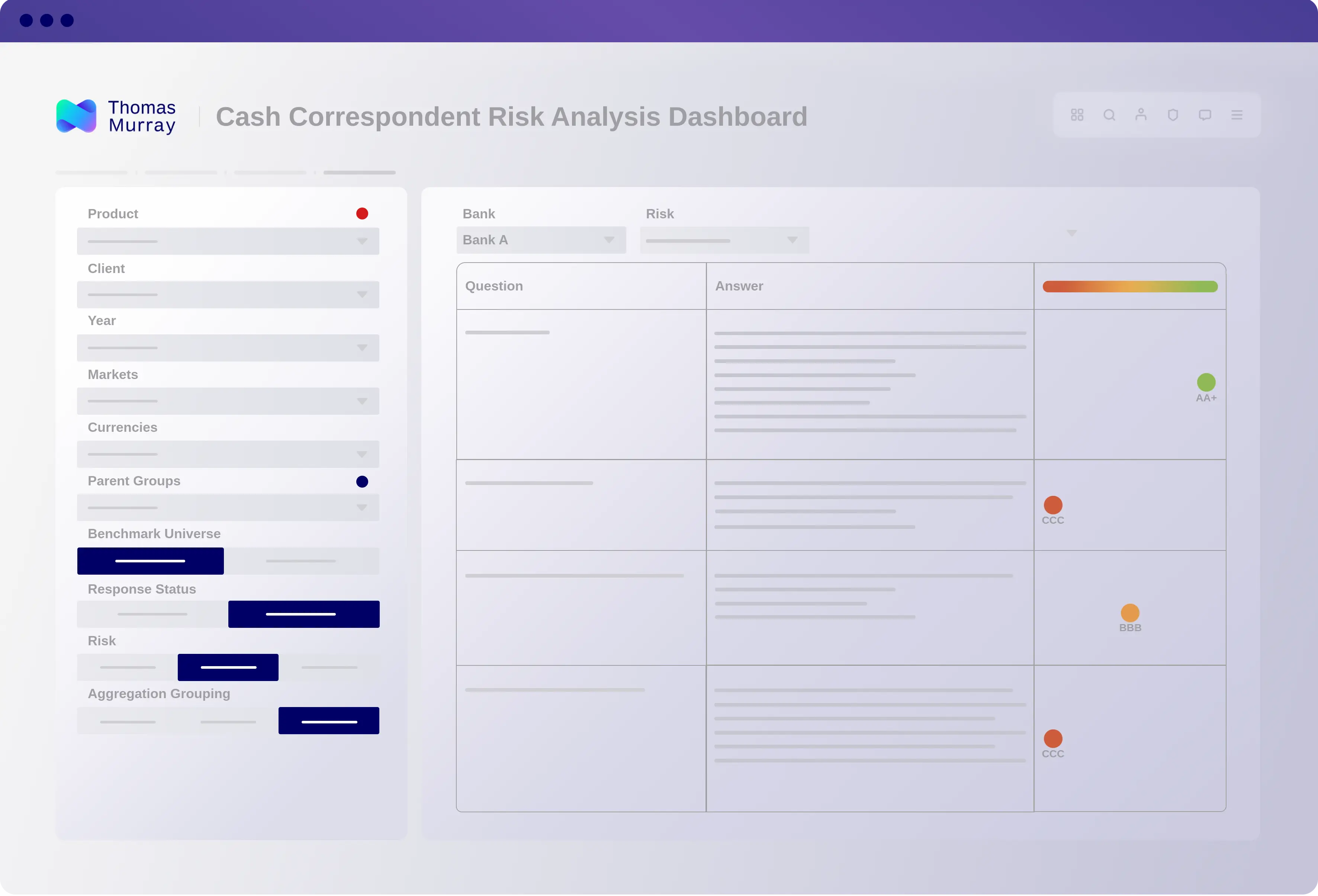

2. Accessing and managing responses- Click on questionnaires for final responses and online communication with banks.

- Download questionnaire responses in a range of formats.

- Detailed audit history maintained and accessible.

- Click on questionnaires for final responses and online communication with banks.

- Download questionnaire responses in a range of formats.

- Detailed audit history maintained and accessible.

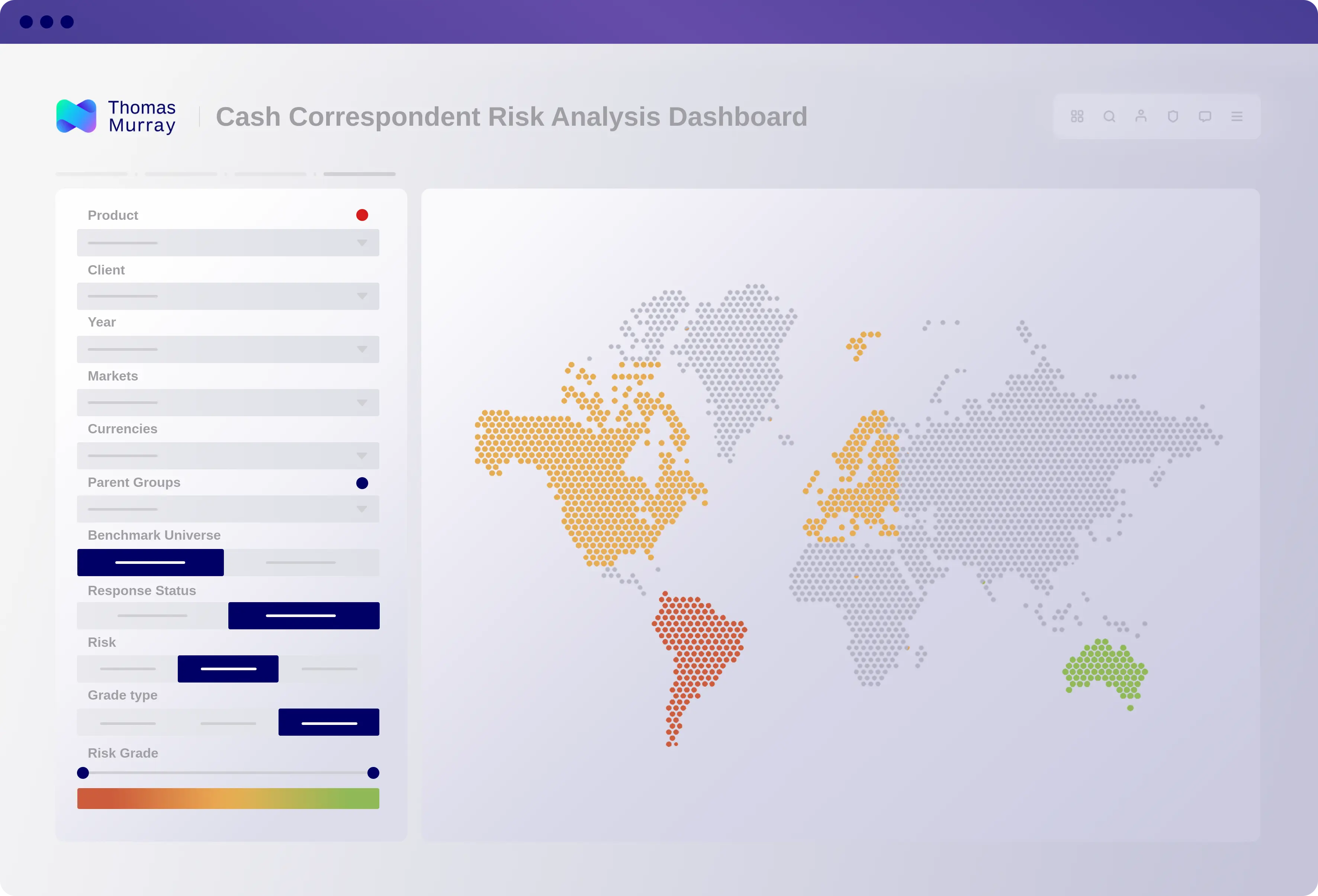

3. Detailed reporting with Orbit Intelligence- Use an interactive map and select reporting criteria, such as jurisdiction, currency.

- Download scored responses in a range of formats for easy distribution.

- View detailed reports, scores, and benchmark comparisons.

- Use an interactive map and select reporting criteria, such as jurisdiction, currency.

- Download scored responses in a range of formats for easy distribution.

- View detailed reports, scores, and benchmark comparisons.

4. Benchmarking and market intelligence- Benchmark banks against your network or the entire Thomas Murray universe.

- Access over 100 cash and treasury market profiles and receive news flashes.

- Benchmark banks against your network or the entire Thomas Murray universe.

- Access over 100 cash and treasury market profiles and receive news flashes.

5. ESG and cyber risk monitoring- Monitor ESG ratings of your correspondents.

- Use the Cyber Risk solution to identify vulnerabilities and benchmark security ratings for all your cash correspondent banks.

- Monitor ESG ratings of your correspondents.

- Use the Cyber Risk solution to identify vulnerabilities and benchmark security ratings for all your cash correspondent banks.

Saxo Markets

"The Thomas Murray service greatly assists us in meeting our regulatory and commercial obligations and facilitates a comprehensive benchmarking capability of service providers. The standardised questionnaire has an added benefit, in that it eases the response burden on correspondent banks. Each group’s responses can be uploaded on a common platform across clients and amended, and only where the service proposition varies."

Pictet Group

"Thomas Murray’s industry-lead technology greatly helps our team to manage all our nostro relationships by giving a complete overview of completion status, completion percentage, and deadlines. As this is a managed service, Thomas Murray creates the projects, sets up the user accounts, chases respondents and provides scoring based on an agreed methodology approach that was created with an initial working group of 25 major banks, which we were delighted to be part of."

Banque Lombard Odier and Cie SA

"This industry-driven programme was inspired by the regulatory, third-party oversight and commercial objectives that all banks face in minimising the risk of loss of client assets and cash. By participating in this Thomas Murray coordinated initiative, we benefit from centralised support, data capture and validation – along with additional comparative benchmarks of our chosen providers, versus other local market alternatives."

Union Bancaire Privée

"The fact that it’s a fully managed service solution has allowed us to focus on other priorities and it has the additional benefit that it supplements our internal process, so we have never delivered such a robust counterparty monitoring programme as we do now."

Insights

NYSE proposes around-the-clock trading

The New York Stock Exchange exploring the possibility of trading on a 24/7 basis has caused both excitement and concern among market participants.

Cash correspondent banking and monitoring: A primer

Correspondent banking, whether traditional or digital, plays a vital role in the international financial system.

Correspondent monitoring: A safeguard against the worst-case scenario

Correspondent banking plays a vital role in the global financial system, though it does carry significant risks.

Liquidity in Ghana and Zambia

The state of foreign exchange liquidity across Africa often shares several key features and challenges that impact the region’s financial markets.

Contact an expert