Thomas Murray launches OrbitAI

Thomas Murray is proud to launch OrbitAI, starting with a virtual cyber security consultant integrated into our Orbit Security platform.

Bye-bye Laybuy: Six cyber security lessons for PE from a BNPL collapse

The recent collapse of Laybuy offers crucial lessons for the PE industry.

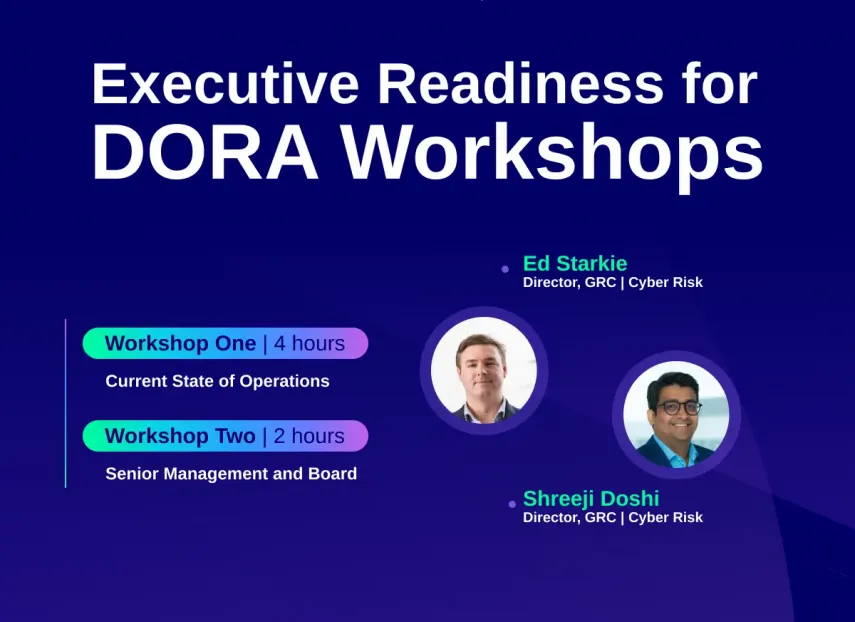

Executive Readiness for DORA Workshops

Our DORA Workshops present an opportunity for executives and board members to understand the scope and implications of DORA for their organisations.

NYSE proposes around-the-clock trading

The New York Stock Exchange exploring the possibility of trading on a 24/7 basis has caused both excitement and concern among market participants.

An overview of the TIBER-EU methodology

The TIBER-EU methodology is a comprehensive framework designed to enhance the cyber resilience of financial institutions.

Finance faces the future: The role of automation in post-trade operations

At times it can seem that, almost overnight, artificial intelligence leapt from the realm of science fiction into our daily lives.

Five minutes with the PE cyber experts

Ed Starkie and Ben Hawkins gave us five minutes of their time to run through the current state of cyber security for private equity.

Understanding supply chain and concentration risks in cloud services

The major incident on Friday, 19 July highlighted the high levels of concentration risk emerging from our technology landscape.

Cash correspondent banking and monitoring: A primer

Correspondent banking, whether traditional or digital, plays a vital role in the international financial system.

Vulnerability alert: CVE-2024-6387

CVE-2024-6387, also known as "regreSSHion," is a critical unauthenticated remote code execution (RCE) vulnerability in OpenSSH.