Addressing the need for digital assets clarity

Thomas Murray, a global leader in risk management, due diligence, and cybersecurity services, is proud to announce the launch of Digital Asset Market Information (DAMI).

As demand for digital assets continues to rise in a globally fragmented regulatory regime where each jurisdiction treats the technology and asset class very differently, asset owners, managers and intermediaries need clear assurances about the legal and regulatory framework that governs these assets, including how they’re defined and classified.

This certainty is essential for understanding the segregation protections that safeguard stakeholders in the event of bankruptcy or insolvency.

DAMI profiles: 18 key jurisdictions covered. 100 markets tracked.

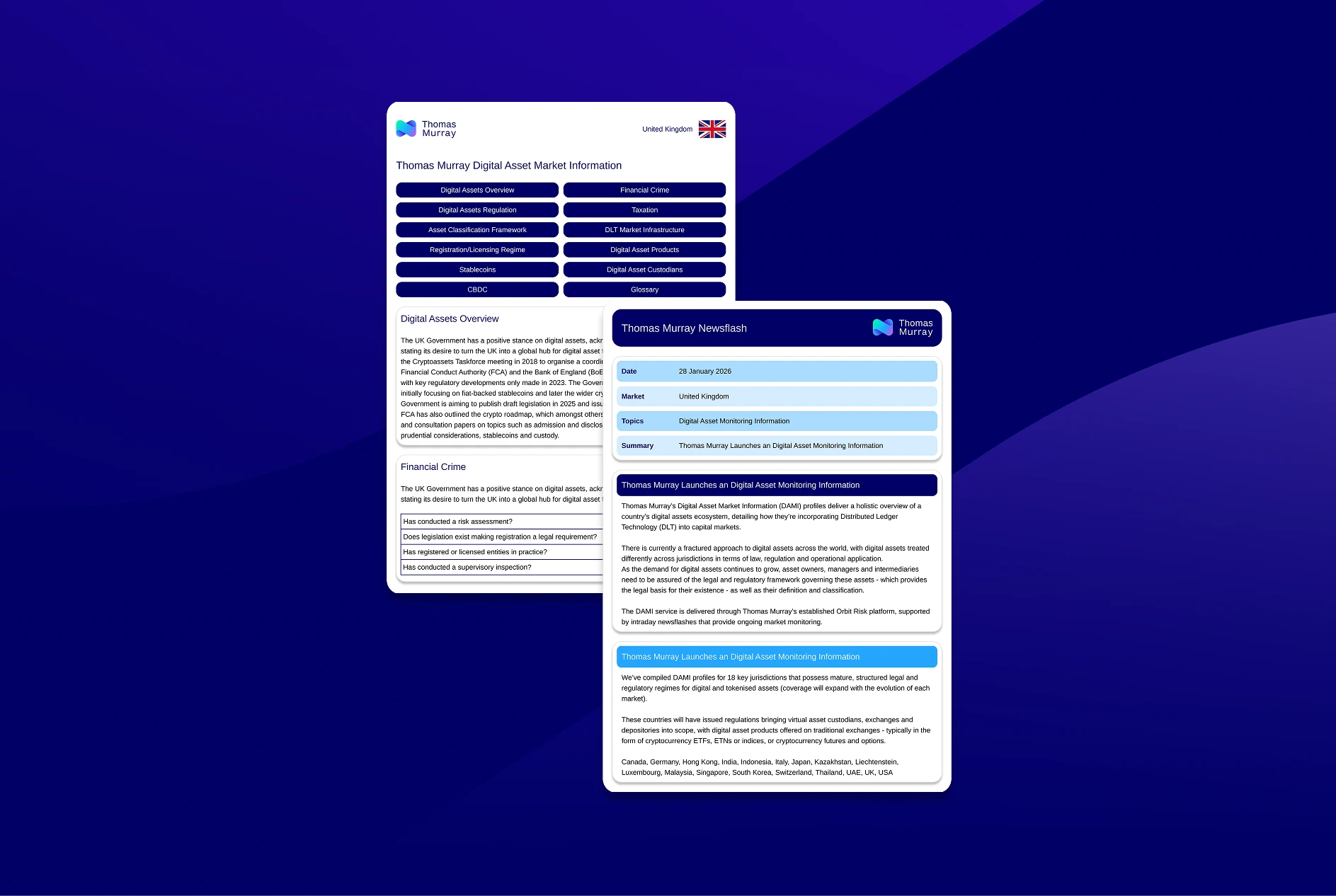

In response to this need, Thomas Murray has created 18 individual digital asset country profiles (further jurisdictions will be added in due course), that offer clarity through uniform, digitised information that enables fast, cross-jurisdiction comparison.

The 18 countries covered by DAMI possess the most comprehensive legal and regulatory frameworks, supported by a growing industry of licensed and/or regulated service providers and infrastructures - including custodians, exchanges, transfer agents, credit institutions, investment firms, market operators and CSDs, among others - all of which facilitate the growing use of digital assets across the capital markets.

DAMI is delivered through Thomas Murray’s established Orbit Risk platform, with 100 markets proactively monitored for real-time developments affecting the markets’ digital asset framework, supported by an intraday newsflash service.

What’s in the profile?

Each DAMI report follows a consistent framework examining a jurisdiction across ten core dimensions:

- Digital assets regulation

- Asset classification framework

- Registration and licensing

- Stablecoins

- Central Bank Digital Currency (CBDC)

- Financial crime

- Taxation

- DLT market infrastructure

- Digital asset products

- Digital asset custodians

Commenting on the launch, Derek Duggan, Managing Director, Banks, said:

“With demand for digital assets continuing to grow, stakeholders including asset owners, managers and intermediaries, need assurance around the legal and regulatory frameworks governing these assets. DAMI country profiles deliver that assurance by offering clarity through clear, consistent, actively maintained information, informing strategic decision-making in a dynamic and challenging environment.”

About Thomas Murray

Thomas Murray is a global leader in risk management and due diligence services, providing innovative solutions to financial institutions, corporations, and governments worldwide. Our expertise spans various domains, where we offer advanced tools and services to protect against emerging threats.

For more information about DAMI and our other products and services, please contact: enquiries@thomasmurray.com