A holistic overview of the digital assets ecosystem

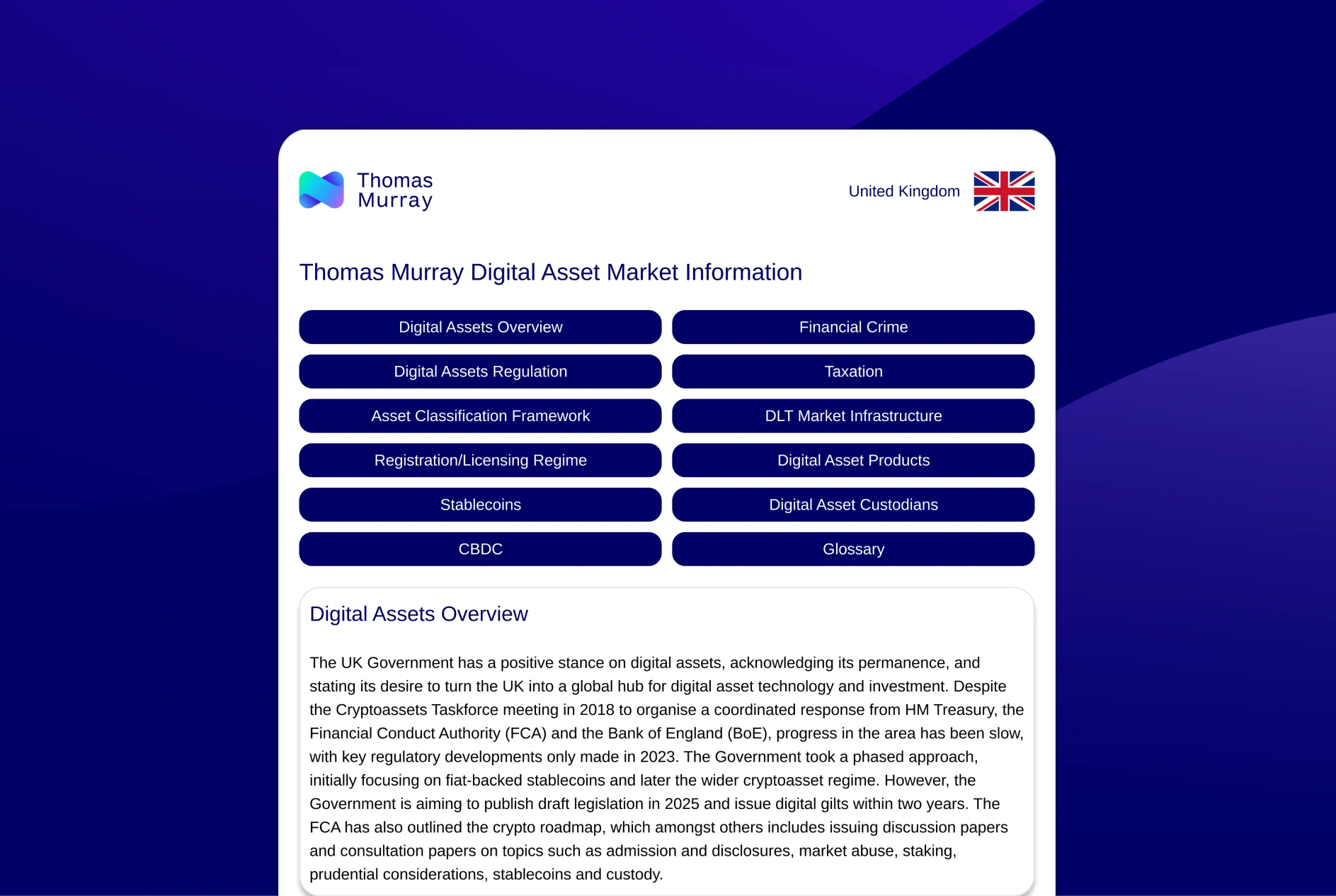

Thomas Murray’s Digital Asset Market Information (DAMI) profiles provide clarity over how markets are adopting blockchain and Distributed Ledger Technology (DLT) into their evolving regulatory frameworks and market infrastructure, shaping tax policy and cross-border coordination, and integrating digital assets (including cryptocurrencies, deposit tokens and stablecoins, and tokenised and native securities) into the broader financial system and economy.

Why is DAMI needed?

As demand for digital assets continues to rise, asset owners, managers and intermediaries need clear assurance about the legal and regulatory framework that govern these assets, including how they’re defined and classified.

This certainty is essential for understanding the segregation protections that safeguard stakeholders in the event of bankruptcy or insolvency.

18 key jurisdictions covered. 100 markets tracked.

The 18 jurisdictions covered by DAMI possess the most comprehensive legal and regulatory frameworks, supported by a growing industry of licensed and/or regulated service providers and infrastructures - including custodians, exchanges, transfer agents, credit institutions, investment firms, market operators and CSDs, among others - all of which facilitate the growing use of digital assets across the capital markets.

DAMI is delivered through Thomas Murray’s established Orbit Risk platform, with 100 markets proactively monitored for real-time developments affecting the markets’ digital asset framework, supported by an intraday newsflash service.

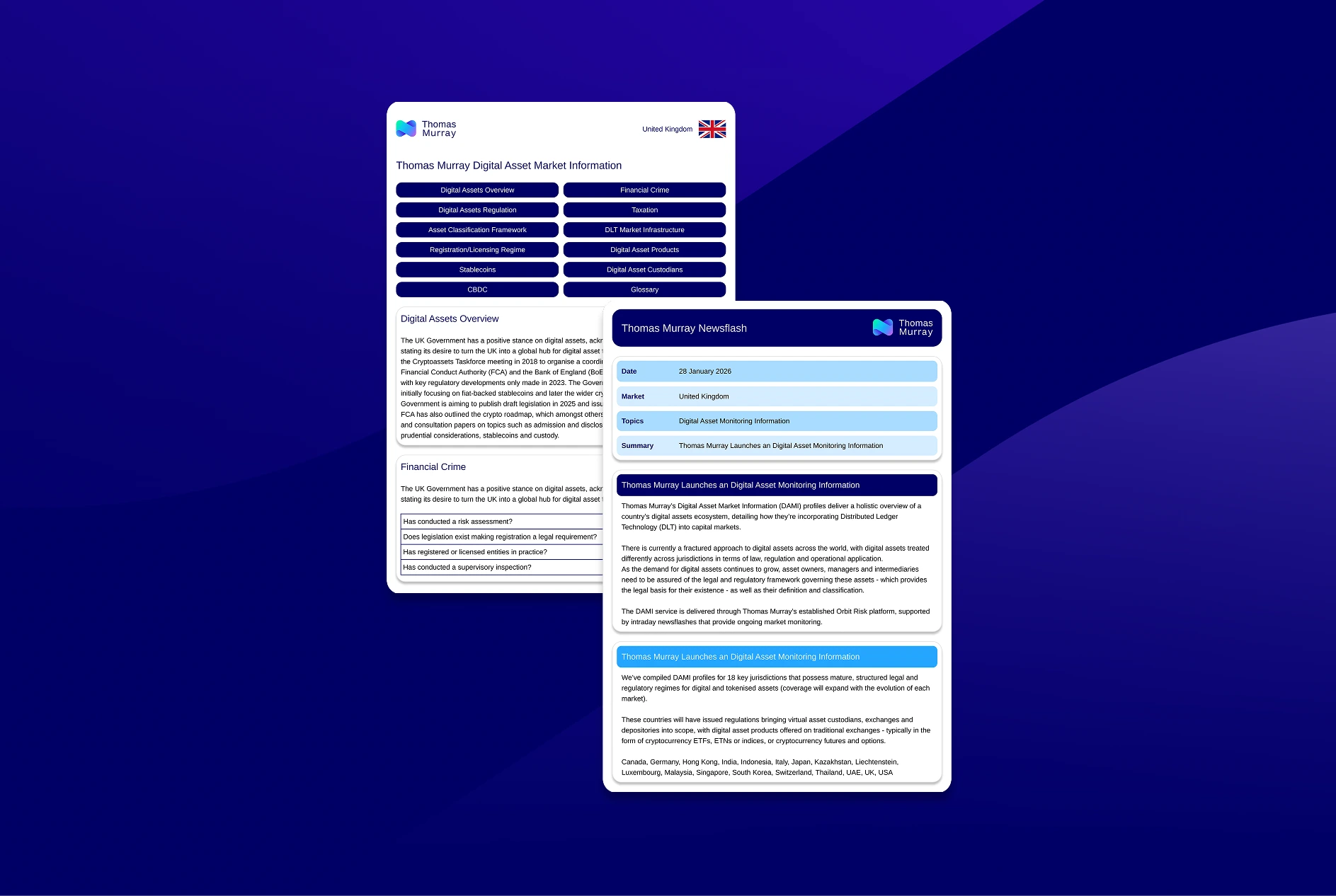

What's in the profile?

Each DAMI profile follows a consistent framework examining a jurisdiction across ten core dimensions:

Digital Assets Regulation

The overarching laws and statutes governing digital assets.

Asset Classification Framework

The regulatory framework and policy guidance governing the different classes of digital assets.

Registration and Licensing

Criteria and procedures for Digital Asset Service Providers (DASPs), including any sector specific authorisations.

Stablecoins

Regulatory stance, asset backing requirements, and consumer protection measures.

Central Bank Digital Currency (CBDC)

Status of CBDC initiatives, design choices, and interaction with private sector tokens.

Financial Crime

Anti-money laundering (AML), counter-terrorist financing (CTF) measures, sanctions screening, and related compliance requirements, including the FATF's Crypto Travel Rule.

Taxation

The treatment of digital asset transactions, capital gains, income, and withholding rules.

DLT Market Infrastructure

The role and regulatory framework of digital asset FMIs (i.e., exchanges and CSDs)

Digital Asset Products

Details of digital and crypto assets supported in the market (in addition to the range of digital asset products available).

Digital Asset Custodians

Details of the digital asset custodians operating in the market.

Cross-jurisdiction comparison for strategic decision-making

This uniform, digitised structure enables fast cross-jurisdiction comparison while delivering deep insights for strategic decision-making.

Need more information on a Digital Asset Market?

Access exclusive information on all of our monitored digital asset markets.

Insights

Navigating the Custody Landscape: A Balanced Approach to Risk Management and Achieving Operational Efficiencies

Custody is no longer just about safekeeping assets. It’s about data integrity, resilience, and the ability to support an institution’s operating model

Institutional Adoption of Digital Assets in 2025: the Factors Driving the Industry Forward

Institutional adoption of digital assets is accelerating in 2025, with the tech now seen as a legitimate force in finance despite early scepticism.

Thomas Murray Launches Digital Asset Custodian Risk Monitoring Service for Financial Institutions

The solution provides institutions with robust monitoring and oversight of chosen digital asset providers and associated downstream counterparties.

Innovations in Digital Asset Custody: Enhancing Security and Multi-Asset Management for Institutional Investors

Discover how cutting-edge technologies and integrated platforms are revolutionising digital asset custody.