About the author

Caroline McCreadie

Director | Cash and Network Manager | Global Network Management

Caroline is an experienced Network Manager. She is responsible for the Middle East and African regions, as well as running our Cash Correspondent Monitoring Programme. Before joining Thomas Murray in 2017, Caroline worked as a Network Manager at Standard Chartered Bank in Johannesburg, South Africa and for many years at Morgan Stanley in London, UK in both Treasury and Network Management.

Dormant accounts pose significant risks to financial institutions. Monitoring and managing these accounts is essential to prevent potential fraud and identity theft. Fortunately, there are strategies for effective monitoring.

What are dormant accounts?

A dormant account is one that has seen no financial activity, apart from interest posting, for an extended period—typically two years. The duration and policies regarding dormancy vary across institutions and regions. Dormant accounts may incur service fees, which often increase the longer the account remains inactive.

Risks of dormant accounts

- Fraud and identity theft: Inactive accounts are vulnerable to fraudulent activities, including identity theft, especially if contact information is outdated.

- Regulatory compliance failures: Financial institutions must comply with regulations such as the UK's Dormant Accounts Scheme, which involves transferring balances of long-dormant accounts to Reclaim Fund Ltd (RFL).

Regional differences in dormant account policies

Different regions have varying standards for dormancy.

In the UK, accounts inactive for 15 years or more may have their balances transferred to RFL.

There are global variations, however. Banks worldwide have differing definitions of dormancy, with periods ranging from 3–24 months.

Proactive management of dormant accounts

Effective management involves:

- Regular monitoring: To assist you in the management of dormant accounts, use tools like Thomas Murray's Cash Correspondent Monitoring to understand your correspondent banks’ dormancy policies and processes.

- Policy awareness: Understanding your bank's policies can help in setting up procedures for handling inactive accounts.

- Client engagement: Encouraging account holders to maintain up-to-date contact information and engage with their accounts can prevent dormancy.

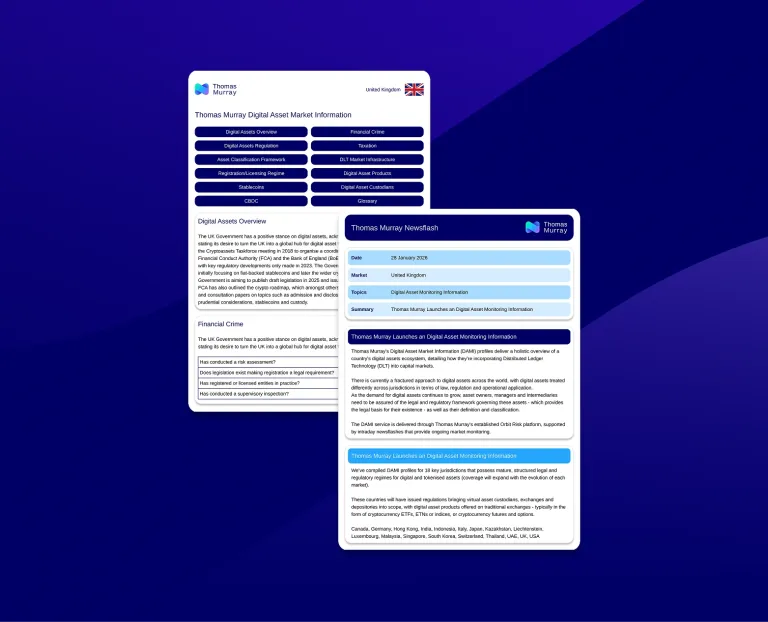

Thomas Murray’s Cash Correspondent Monitoring

Thomas Murray offers tools to help organisations understand and manage dormant account policies:

- Policy analysis: Insight into how different banks handle dormant accounts.

- Cost reduction: Effective monitoring can lead to significant long-term cash savings.

Thomas Murray’s analysis has identified areas where clients could net significant savings.

Based on the nearly 400 submissions to the most recent Thomas Murray Cash Correspondent Monitoring due diligence review, 14% of banks indicated they operate only with active or terminated accounts, meaning they do not recognise the concept of a dormant account. Of the banks that do recognise dormant cash accounts, only a small minority regard just 3–6 months of inactivity as being sufficient to classify an account as dormant. More than 48% of all banks deem a more reasonable time frame to be 12–24 months and longer.

Effective management and risk reduction

Dormant accounts, if not properly managed, pose risks of fraud, identity theft, and regulatory non-compliance. Financial institutions must adopt proactive monitoring and management strategies to mitigate these risks and ensure regulatory compliance. Tools like Thomas Murray’s Cash Correspondent Monitoring can aid in effective management and cost reduction.

For more information on how to manage dormant accounts and reduce their associated risks, contact our experts.