The Risk

Institutional Investors appoint Global Custodians for their fund administration and accounting, settlements, and corporate actions across multiple assets classes: equities, bonds, cash, derivatives, hedge funds, real estate, and private equity. Global Custodians support investment across markets and appoint sub-custodians (agent banks) in markets where they do not have a presence. Choosing and reviewing global custody arrangements is a critical task that Institutional Funds undertake regularly, but opaque fee structures, lack of transparency and a disinclination to move assets can leave Funds underserved and over-charged.

The Solution

Thomas Murray's Fund Advisory team are experts in Securities Services. They carry out consulting engagements, benchmarking reviews and RFP processes for Asset Owners and Asset Managers to find the best possible global custody arrangements, and to ensure they are compliant with their counterparty evaluation, selection, and monitoring requirements.

We safeguard clients and their communities

Petroleum Development Oman Pension Fund

“Thomas Murray has been a very valuable partner in the selection process of our new custodian for Petroleum Development Oman Pension Fund.”

ATHEX

"Thomas Murray now plays a key role in helping us to detect and remediate issues in our security posture, and to quantify ATHEX's security performance to our directors and customers."

Northern Trust

“Thomas Murray provides Northern Trust with a range of RFP products, services and technology, delivering an efficient and cost-effective solution that frees our network managers up to focus on higher Value activities.”

Insights

Why 72 hours is the New Standard for M&A Cyber Due Diligence

A decade ago, cyber due diligence sat somewhere between “nice to have” and “we’ll deal with it post-close.” That world no longer exists.

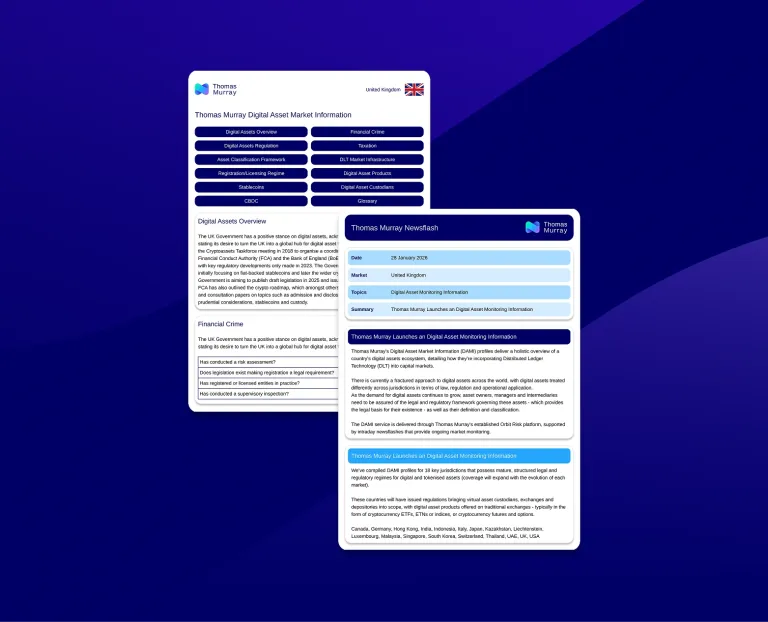

Thomas Murray Launches Digital Asset Market Information (DAMI)

Thomas Murray, a global leader in risk management, due diligence, and cybersecurity services, is proud to announce the launch of Digital Asset Market Information (DAMI).

Solving the "Scale Paradox": How to Automate Portfolio Oversight with Fewer People

In 2026, private equity technical teams are facing a "Scale Paradox": portfolios are growing in complexity, while in the internal teams responsible for operations and cybersecurity oversight, headcounts remain stagnant.

How Private Equity Hackers Choose Their Targets

Private equity firms sit at the intersection of high-value financial transactions, sensitive deal data, and an expanding portfolio of technology heavy portfolio companies – and it’s this combination that makes PE an attractive target for cyberthreat actors.

Contact an expert