About the author

Stephen Merry

Director | Head of Advisory and Analytics

Steve Merry is Head of Advisory. He is also responsible for our Custodian Monitoring and Oversight business. Steve joined us in 2004 as an intern and is now an expert in the global custody and post-trade space. He assumed responsibility for our consultancy practice in 2014, and has overseen our expansion into new markets and the development of our Custodian Monitoring and Oversight business.

In 2021, 8% of cash correspondent banks told us that they commit to clearing funds only within eight hours or on the next business day after receipt of the funds. The findings revealed that the speed at which client cash is posted to accounts after clearance differs by country/region, and is significantly slower in the Asian and African markets.

Why should organisations be concerned about whether funds have cleared?

Your account may be in a cash deficit position. This could cost your organisation if you do not have an agreed overdraft limit in place -- and the overdraft costs can be substantial.

Conversely, your account may be in a cash surplus position. If this is the case, then there may be large sums of money sitting in your accounts that could be invested and earning interest. If you leave funds in your account for even a few days, a significant amount of potential interest could be lost.

The solution

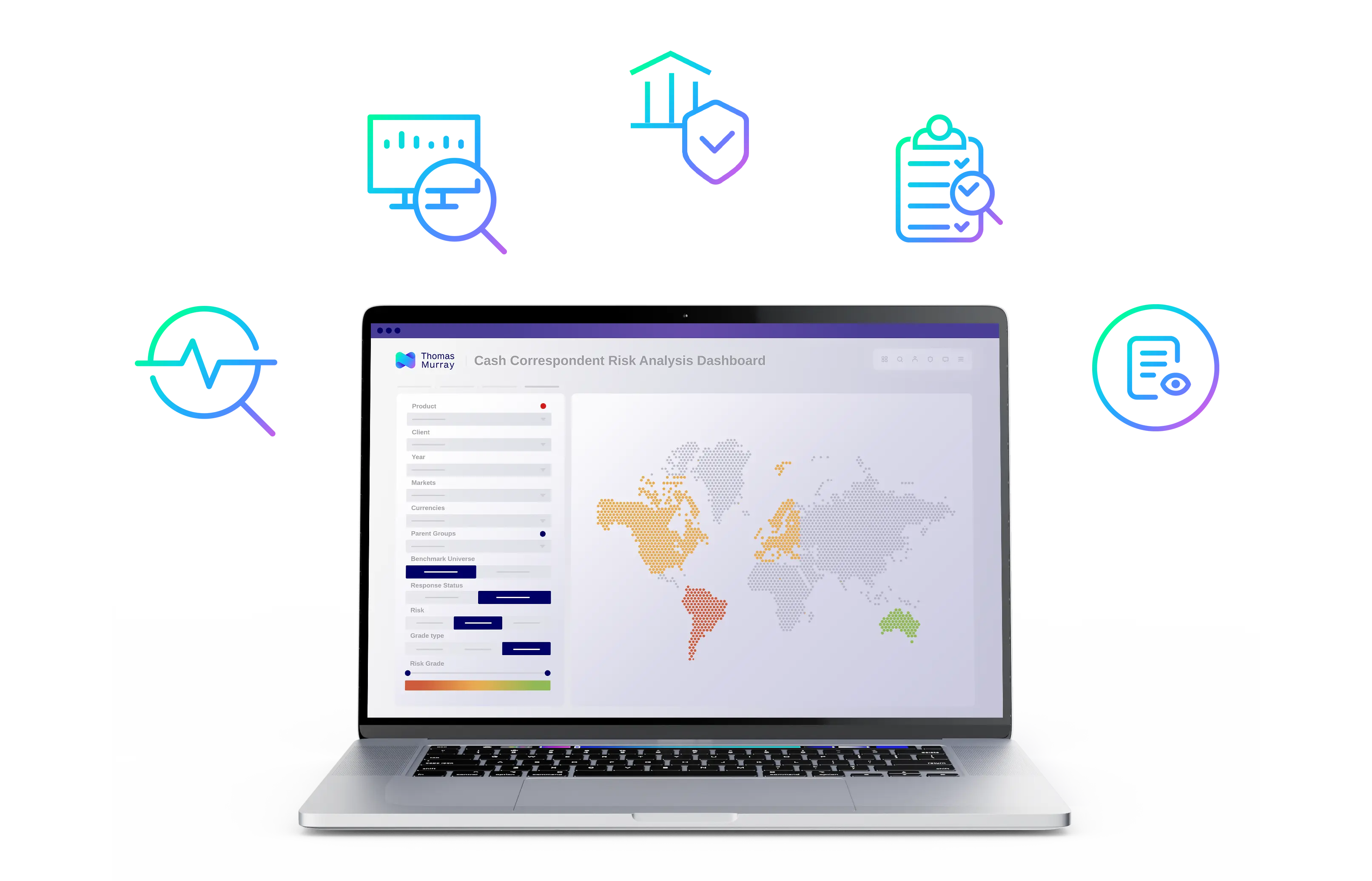

Thomas Murray's Cash Correspondent Monitoring tool helps organisations to understand how quickly funds are cleared on accounts per country and region. By understanding how quickly funds are cleared to your accounts, treasury departments can accurately optimise and reduce costs.