Welcome to the Future of Custody

At Thomas Murray, we have developed a managed service that aims to revolutionise the way digital asset custodians are evaluated, managed, and monitored. Following client and industry demand, we are addressing the need for comprehensive, trustworthy risk management of custodians in the digital assets ecosystem. As digital assets gain prominence in global investment portfolios, ensuring robust protection of the asset with secure, compliant, and operationally resilient Custodians is of paramount importance.

Our Digital Assets Custody Monitoring (DACM) programme equips Institutional Investors and Financial Institutions with the tools and insights to evaluate, select and monitor their digital asset custodian, against an industry that is complex, fragmented, unstandardised, and fraught with cyber risk.

Digital Asset Custodian Monitoring

The digital assets industry is growing exponentially, with tokenised assets projected to reach US$30 trillion by 2034. This growth presents new challenges and risks for both the buy and sell side, which need to be effectively managed.

Thomas Murray brings decades of experience in risk management and due diligence in the traditional financial markets and now, we are applying that expertise to digital assets, creating a comprehensive monitoring framework fostering robust and reliable digital asset ecosystems.

Our DACM programme is designed to meet the needs and expectations of financial institutions, with the risk framework evolving to keep concurrent with the rapidly changing landscape. Given today’s reliance on critical third parties, our solution extends beyond the appointed custodian and examines the security posture of their counterparties, including wallet providers, data centres, and cloud infrastructure, ensuring the full value chain is captured and monitored.

Thomas Murray's Monitoring Expertise

40+

15+

330+

700+

20

1,500+

11

Key benefits of DACM

For Digital Asset Owners:

- Peace of Mind: Secure your assets with custodians that meet the highest security, and operational standards.

- Ongoing Risk Monitoring: Continuous assessment of your custodian(s) across a range of key risk areas, benchmarked against a like-for-like peer group.

- Early Adoption Advantage: Be a leader in adopting the standardised risk management framework for the digital assets industry.

For Financial Institutions:

- Peer Collaboration: Collaborate with industry peers to continuously refine and improve the standards for digital asset custody.

- Digital Strategy: Enhance your business model, by aligning with industry leading custodians that meet the standards necessary to drive your strategic objectives for Digital Assts and Web3.

- Market Trust and Credibility: Enhance your reputation and credibility by aligning with Thomas Murray, a globally recognised leader known for establishing industry-standard frameworks and risk assessments.

- Benchmarking and Evaluation: Regular assessments to strengthen your custodial services and stay competitive.

- Regulatory Compliance: Stay prepared for evolving regulations with an effective risk management methodology that aligns with global standards.

Navigating the Digital Asset Custodian Monitoring with Thomas Murray’s Orbit Risk

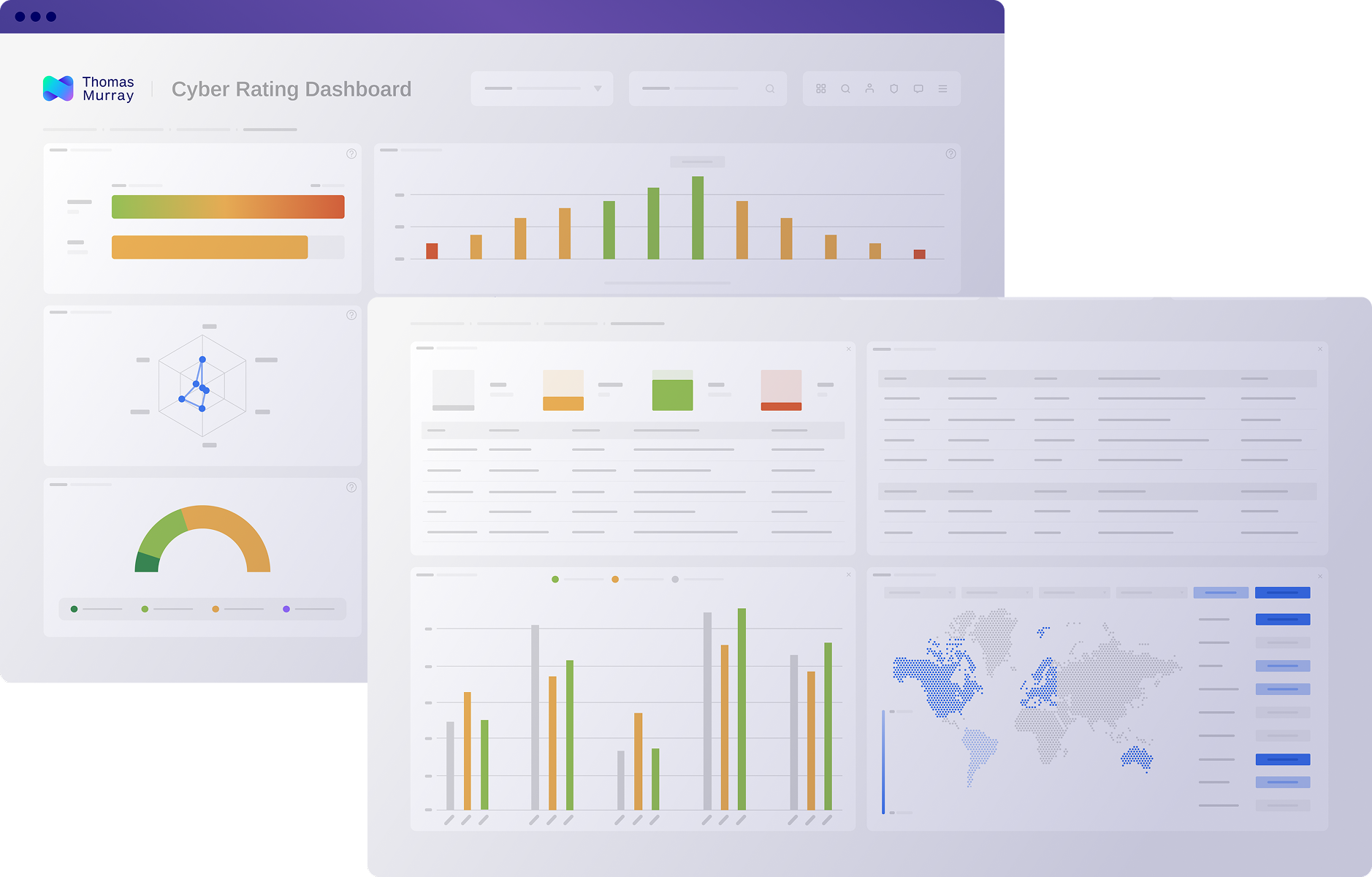

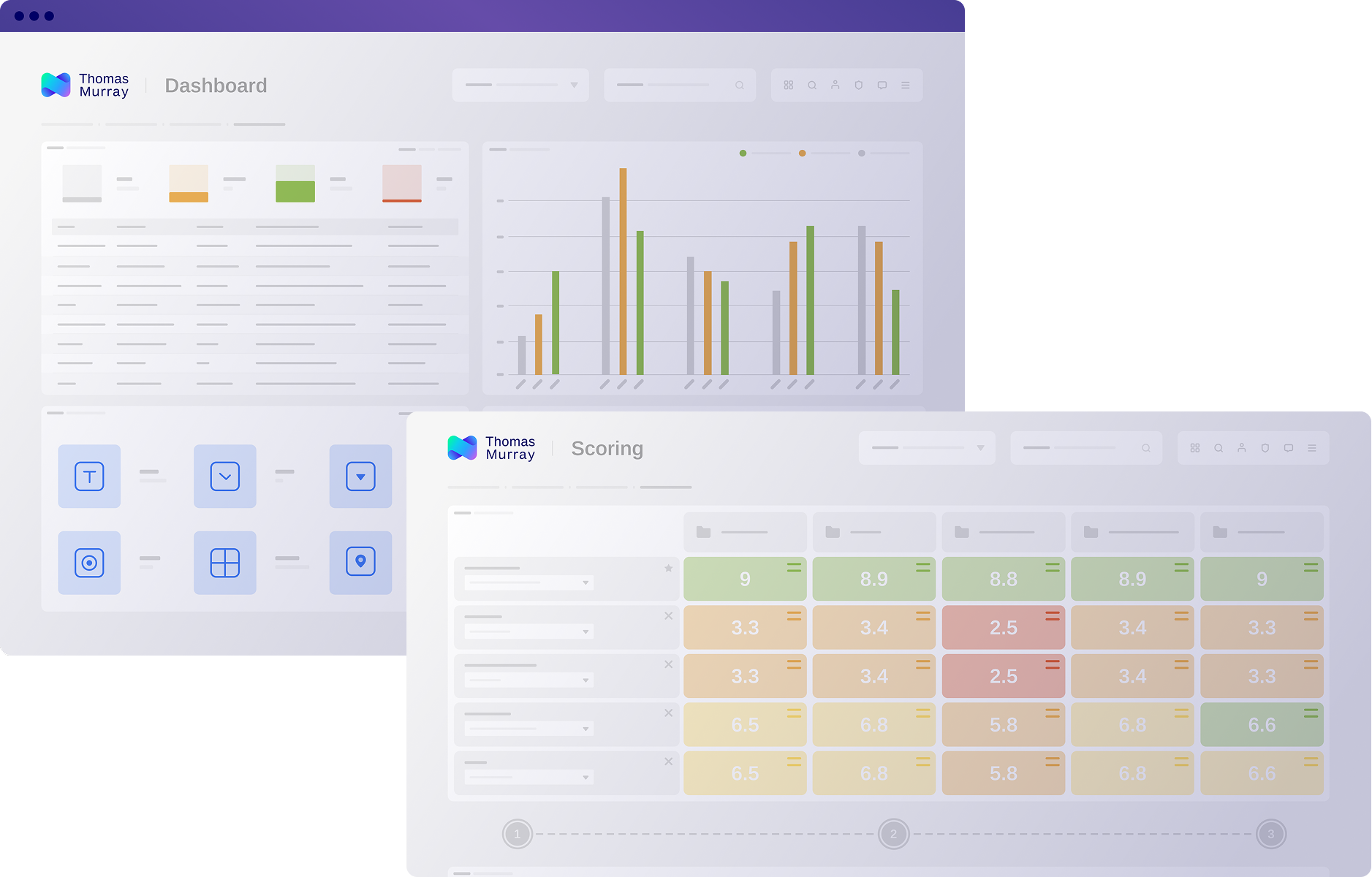

Participants in our DACM programme will have access to a robust suite of tools, frameworks, and collaborative opportunities designed to enhance risk assessment and oversight. Through the DACM programme, Thomas Murray’s Orbit Risk platform offers a comprehensive solution for managing digital asset custodian risks. With My Portfolio, users can view their entire network of counterparties through a single dashboard, and by clicking on any Entity Profile, they can dive into specific risk mitigation tools and outputs to gain deeper insights, such as:

Cyber Security | Orbit Security module- Tracks cyber risks of all digital asset custodians and associated counterparties.

- Includes exposure tracking across technology groups, data centres, vaults, exchanges, brokers, clearers, and more.

- Tracks cyber risks of all digital asset custodians and associated counterparties.

- Includes exposure tracking across technology groups, data centres, vaults, exchanges, brokers, clearers, and more.

Questionnaire Management | Orbit Diligence module- Managed service for issuing and evaluating agreed questionnaires.

- Comprehensive review of responses, aligned with agreed methodologies.

- Development of provider assessments, including benchmarking insights.

- Managed service for issuing and evaluating agreed questionnaires.

- Comprehensive review of responses, aligned with agreed methodologies.

- Development of provider assessments, including benchmarking insights.

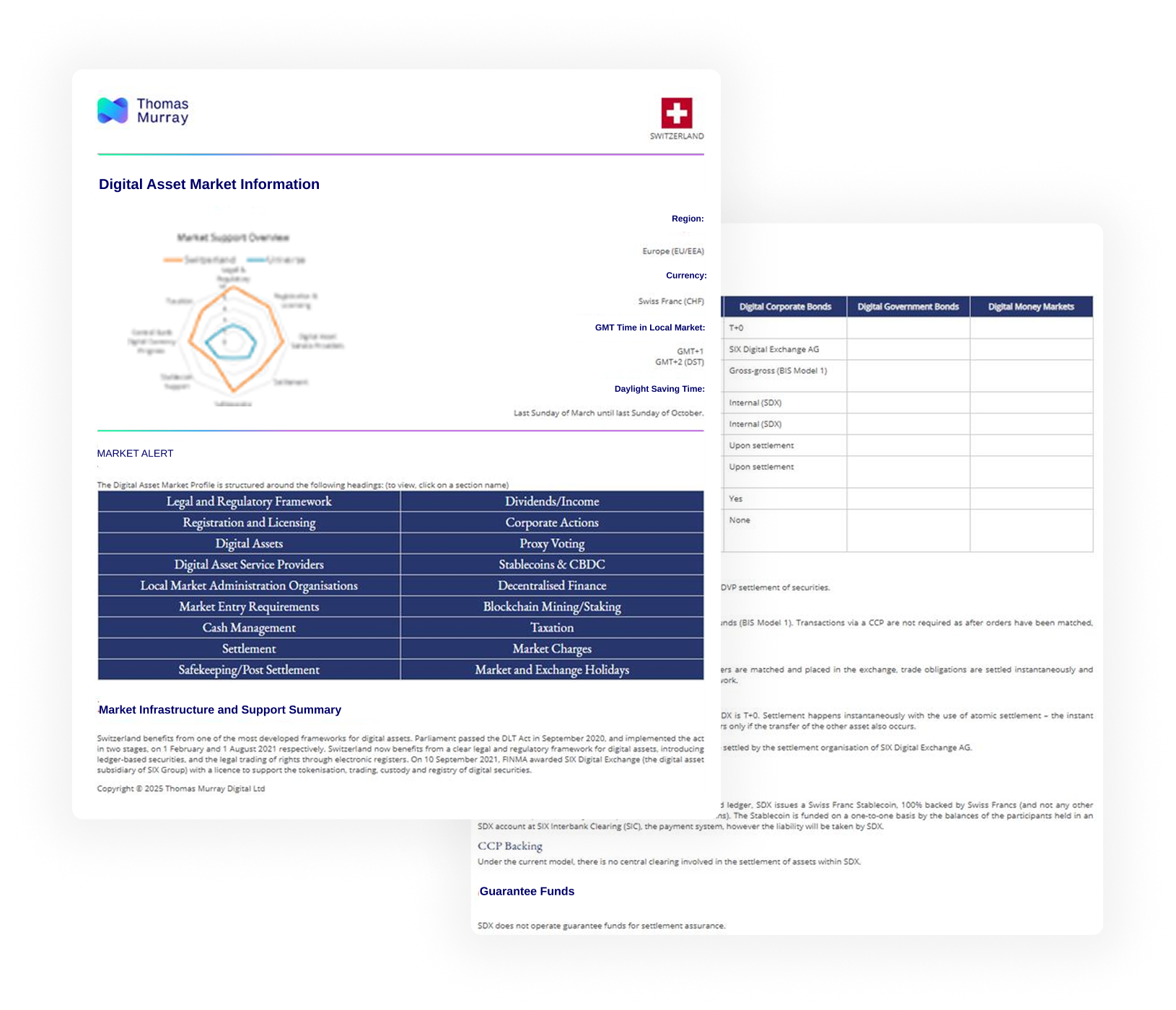

Digital Asset Market InformationThe Digital Asset Market Information (DAMI) product provides a comprehensive view of how digital assets are recognised, treated, and overseen in each market and examines technical areas including the Legal, Regulatory and Licensing Environment, integration with existing market infrastructures, Settlement, Stablecoins and CBDCs, Taxation, and more.

The Digital Asset Market Information (DAMI) product provides a comprehensive view of how digital assets are recognised, treated, and overseen in each market and examines technical areas including the Legal, Regulatory and Licensing Environment, integration with existing market infrastructures, Settlement, Stablecoins and CBDCs, Taxation, and more.

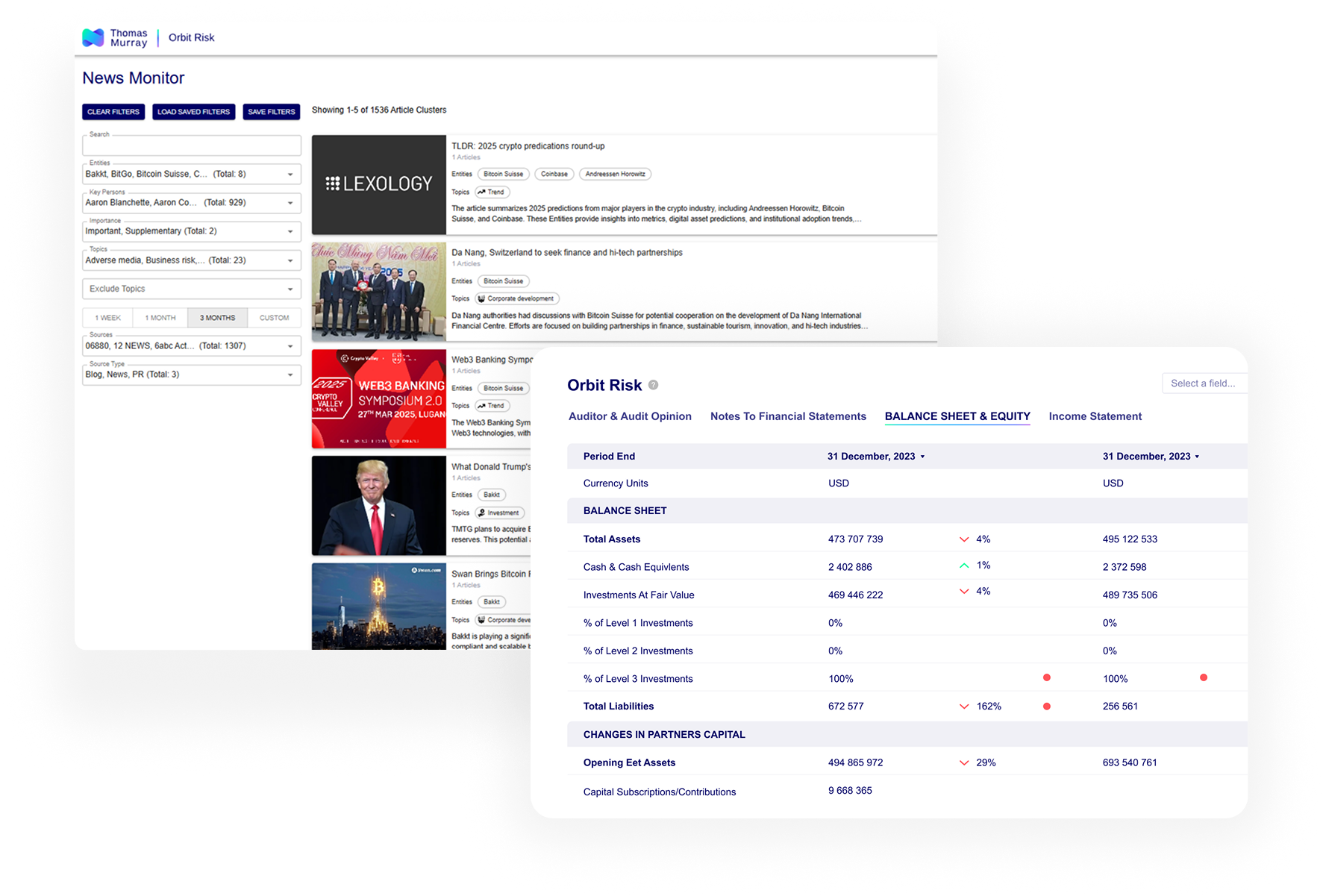

Ongoing MonitoringProactive monitoring of digital providers, including real time news monitoring, financial monitoring, and newsflashes advising of ongoing changes.

Proactive monitoring of digital providers, including real time news monitoring, financial monitoring, and newsflashes advising of ongoing changes.

Comprehensive Risk Management of Digital Asset Custodians

Leveraging our industry-leading approaches to risk categorisation, our Digital Asset Custodian Monitoring addresses all the critical operational risk elements essential to the effective safeguarding of digital assets, which in addition to the traditional operational risk elements include:

Cyber Security

The risk of a breach, leading to the loss or theft of client assets, which could result in significant reputational damage, financial difficulties, and potential regulatory penalties. Key areas to address include:

- Vulnerability Assessments and Penetration Testing

- Third-Party Risk

- Incident Response Plans

- Ongoing Monitoring (Orbit Security)

Asset Safety

The risk of asset loss due to breakdowns in safekeeping practices and related security controls. Key areas to address include:

- Legal & Regulatory Compliance

- Key Policy and Management

- Secure Architecture

- Wallet & Account Structures

Asset Servicing

The risk that a provider may be limited in its ability to effectively service digital assets, leading to potential losses or missed opportunities. Key areas to address include:

- Events Policy and Support

- Staking and DeFi

- Token Event Processing

- Blockchain Governance

Operational Risk

The risk of client loss due to breakdowns or weaknesses in a digital custodian's controls or procedural framework. Key areas to address include:

- Financial Crime Policies and Tools

- FATF Travel Rule Compliance

- Operational Resilience/BC/DR

- Audit

- Protection Against Bad Actors

Financial Risk

The risk that a digital custodian has insufficient financial resources to withstand operating pressures, or a sustained cyber-attack on its business. Key areas to address include:

- Insurance: Ensure appropriate insurance policies exist which address digital asset-specific risks, including loss of keys and cybercrime.

- Enhanced Financial Analysis: Examination of the Custodian’s balance sheet backing, key ratios, and solvency.

- Blockchain Proofs (where applicable): Solvency/Reserves/Assets/Liabilities.

Let’s Get Connected: Support for Digital Asset Custodian Monitoring

Connect to find out more about how Thomas Murray can support your evaluation and monitoring of digital asset custodians.

Our Digital Asset Custodian Monitoring Experts