Contract review

The purpose of this review is to establish the degree to which the custodian agreement with the incumbent custodian minimises the core custodial risks (e.g., asset safety, asset servicing and operational) to which you might be exposed.

Thomas Murray is in a unique position because we have intelligence on the latest commercial and contractual terms offered by custodian banks on a global basis.

The report would highlight variances or omissions, recommending remedial action where appropriate, and commenting on its adequacy in as much as it enables you to secure the required level of service and risk minimisation from your global custodian.

Additional services

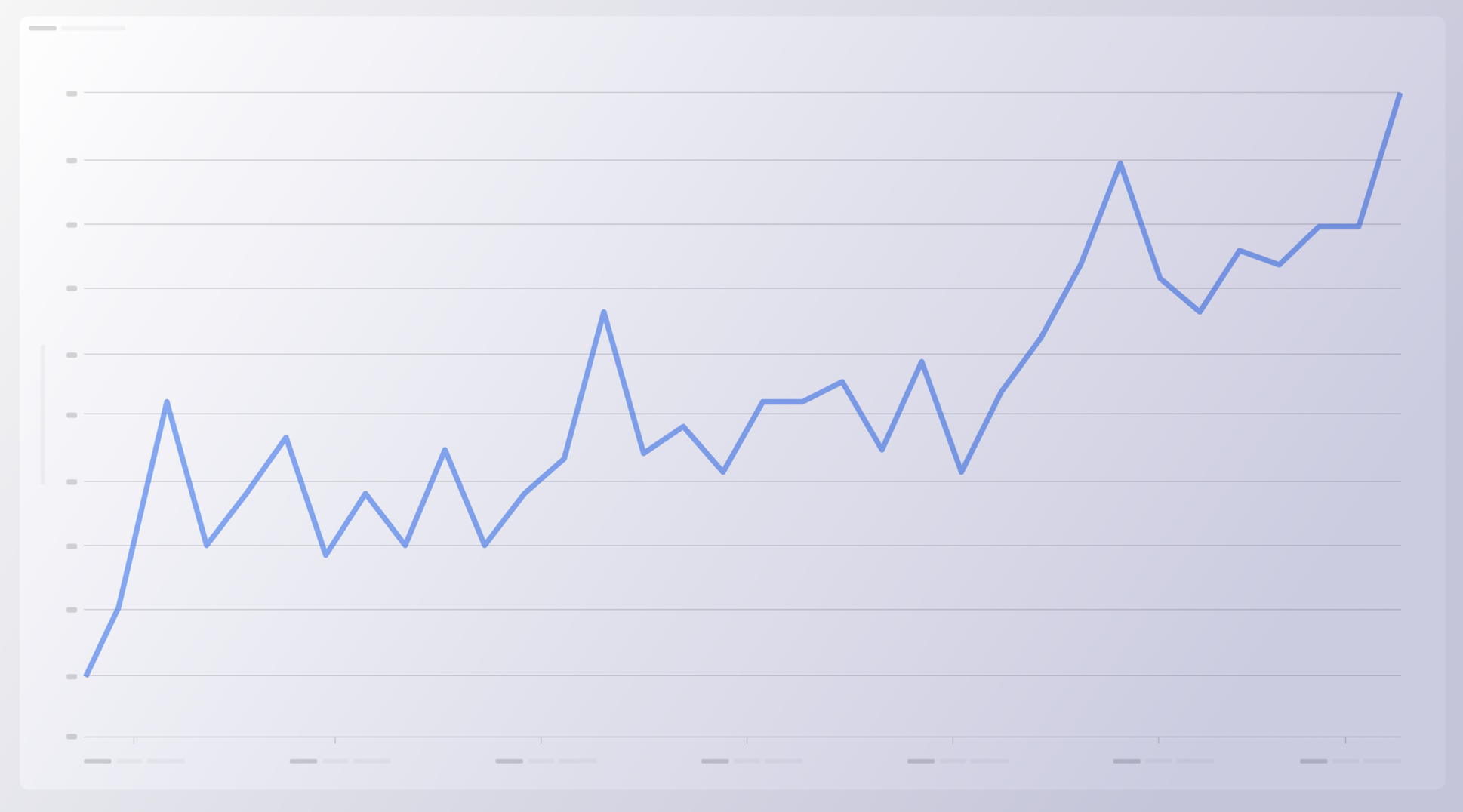

Financial analysis: Quarterly Custodian Bank Peer Group Comparison

You can request a Quarterly Custodian Bank Peer Group Comparison report that will compare the financial indicators (Tier 1 Capital Ratio, Total AuC, Liabilities, Revenue etc.) of the leading custody providers.

Once the results are published, we can arrange a quarterly call to discuss any issues or trends that we have observed from our global client base and your feedback.

Operational benchmarking

Operational Benchmarking (OpBench) is our interactive tool that allows you to benchmark your custodian’s operational performance against a universe of other Thomas Murray clients.

You can customise your own universe, whether by custodian, geography, type, or size. If you retain multiple custodians, the tool allows you to create your own service provider universe.

Thomas Murray takes data directly from the custodian and our Managed Service team ensures that the data is accurate, and that any discrepancies or outliers are interrogated with the custodian before uploading it to OpBench.

SLA benchmarking

We regularly review Service Level Agreements (“SLA”) for our global client base. These reviews provide an assessment of the existing agreements and a gap analysis, which is graded in order of significance and materiality.

The report and subsequent commentary comments on the SLA scope and completeness as a basis for operational performance reporting. The commentary will reflect TM’s experience and evaluation of other agreements for similar clients.

Capability assessment

This assessment looks at certain service aspects to identify the incumbent custodian’s capabilities in these areas, which are then compared against our view of global best market practices.

The scope can be customised to your requirements, whether that is core custodian services, middle office services or data, technology, and ability to integrate with your current or future operating environment.

Contact our experts

Insights

Operational Due Diligence in Australia: Meet APRA Standard CPS 230

Coming into effect on 1 July 2025, this standard aims to ensure that APRA-regulated firms can effectively manage and mitigate operational risks.

Operational Due Diligence and Regulations in Canada

As regulators continue to strengthen their focus on operational risk management, Operational Due Diligence (ODD) has become crucial for Canadian funds

Central Bank of Ireland: UCITS Permitted Markets Regulation

The Central Bank of Ireland UCITS Permitted Markets Regulation relates to the eligibility criteria for markets into which UCITS funds can invest.

The essential role of fund administrators in investment funds

Fund administrators are specialised service providers that handle the administrative and operational aspects of investment funds.