- Home

- Case Studies

- An Innovative Investment Service

The challenge: Lack of quality data

Our client, an innovative investment service, is committed to supporting the Sustainable Markets Initiative (SMI). The SMI aims to unite the private sector in a worldwide effort to push forward on global climate, biodiversity and Sustainable Development Goal targets.

Our client wants to be able to do two key things:

1. assess market eligibility under the terms of the SMI; and

2. meet its regulatory obligations under the Collective Investment Schemes Regime (CISR) (as set out in the UK Financial Conduct Authority (FCA) Handbook).

The client is particularly concerned with the three CISR requirements governing eligible markets, set out under rule COLL 5.2 (General investment powers and limits for UCITS schemes).

The CISR is not new, but compliance can be difficult because of a lack of readily available and comprehensive data on global markets and their exchanges.

How we helped

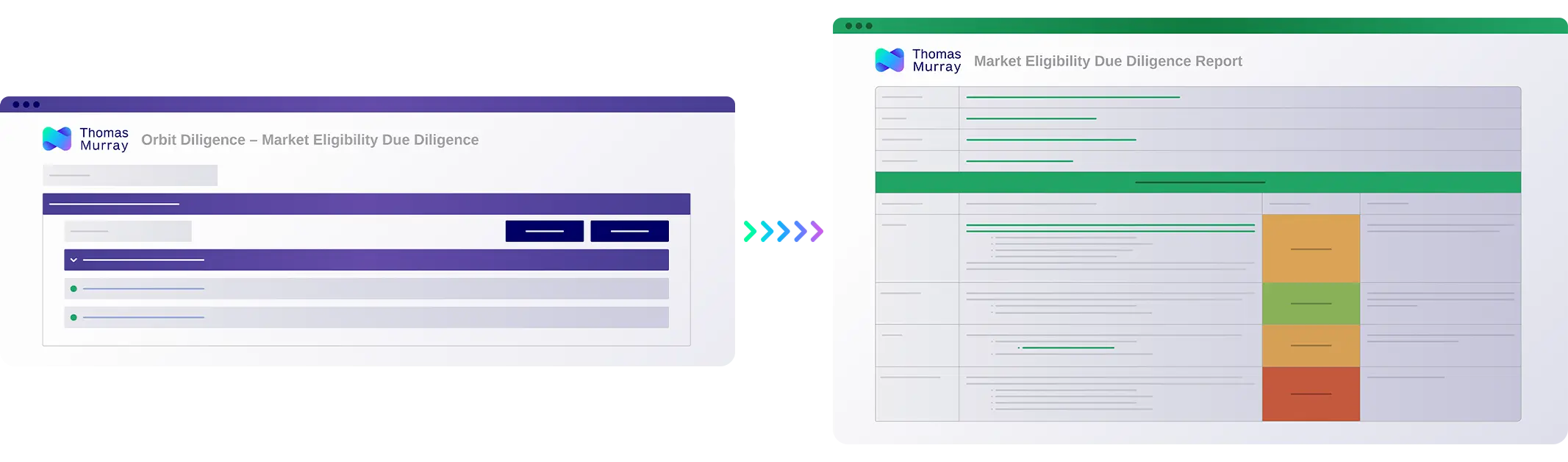

There is no limit to the number of countries that can be accessed through our database. This means that the client can use the Market Eligibility form in Orbit Diligence to quickly identify the suitability of any given market against the requirements of the CISR and the SMI.

The form has five sections. The top three apply to UK-based exchanges and can be answered by the client directly. Section four has specific questions designed to determine if a non-UK based exchange is regulated, liquid and accessible to foreign investors.

The data fields in SMI have been mapped for the market where the relevant stock exchange is based, ensuring that responses to those questions are relevant.

The fields include both specific information about the exchange and general information about the market the exchange serves. The client decides whether the market meets its requirements, using our data to support its decision.

The result is an informed decision, based on reliable and high-quality data.

We designed the second form, Operations Suitability, to answer a set of questions designed by the client to establish market eligibility. This form will be used if the Market Eligibility form confirms that the exchange might be eligible.

The report organises all the fields from both the SMI and CSD reports into tabs, giving the client all the necessary information it needs to answer its queries and effectively interrogate the database.

The client finds both forms useful, and they save the firm time when it’s looking for specific information in SMI reports.

Director of a Major Middle Eastern CSD

“The evaluation is very beneficial not only for our IT Security team but for the company as a whole. As CSDs we have to be as prepared as we can be against cyber risks, so Thomas Murray’s new initiative will be a golden key for that.”

Director of Cyber Security, Latin American financial institution

“The tool is good for us to identify cybersecurity risks to which our domain and its sources are exposed, as well as how to mitigate them.”

Head of Network Management, a European Bank

“Thomas Murray provided information we do not get by any other means today. It’s very useful. The tool is impressive and a nice answer to a problem in the banking industry: how do you manage a large network of service providers, distributors, partners and other third parties without costs creeping up? Cyber is going to be on the agenda for years to come and this tool is going to help us to keep ahead of our third-party risk management requirements.”

Cyber Specialist, third-party risk management at a US bank

“Responses to cyber questionnaires can be very PR-focused, and it’s difficult to get transparency. Security ratings cut through poor response rates to provide a health check based on objective, verifiable public data. We have integrated Thomas Murray’s cyber risk ratings and threat intelligence into our monitoring of agent banks and CSDs globally, and are looking to add additional groups from across the bank.”

IT Security Officer at a Central European bank

“The tool is well-designed and very user-friendly. Monitoring service providers and other third parties’ cyber risk is going to become a regulatory imperative soon; right now it is best practice and something banks should be looking at. Thomas Murray’s platform is great for monitoring our third parties, particularly those who are not very transparent in their DDQ responses. We really like the ability to benchmark our bank and our service providers against like-for-like peers and competitors, this is really important.”

CISO responsible for TPRM at a Global Bank

“The established US threat intelligence providers are expensive and only part of the puzzle. Thomas Murray’s new platform is a very, very good tool for managing our third parties – it is fully automated and isn’t ‘noisy’, which can become a serious relationship issue with some providers. My team really likes the look and feel of the platform as well as the clarity of thought that has gone into making this tool.”

IT Security Specialist of a Swiss financial institution

“Thomas Murray Cyber Risk is a great complement to the tools we use today. It provides much more comprehensive information around the vulnerabilities in our IT infrastructure – and particularly has a lot more details about breached employee emails and passwords than other providers. This is extremely helpful as it allows us to contract those employees with specific, actionable intelligence, and so that we can improve the email behaviour of all staff.”

CISO of an African financial institution

“The tool is very interesting. It gives us the capability to be proactive, rather than reactive, about building the security of our core infrastructure. We are a regulated company and subject to military surveillance by our government; Thomas Murray’s tool used ethical and indirect methods to discover every week the vulnerabilities that we would normally identify during our annual penetration testing.”

Head of IT Security of a Latin American stock exchange

“The Cyber Risk platform is more complete than our existing vulnerability scanning, and we will use it to either replace or complement it. The benchmarking in particular is extremely useful.”

Director of a large Turkish financial institution

“We have been able to make major improvements to our critical applications since using the tool, increasing our score and identifying further action points to stabilise our overall rating in future. Thomas Murray has enabled us to improve our internal processes as well, by pulling together all the necessary threat intelligence feeds so that my team can focus on implementing the findings, instead of gathering the data.”

CISO, Global Custody Bank

“Thomas Murray Cyber Risk’s approach is sophisticated. Its machine learning algorithm identifies our third parties’ public IT infrastructures with huge accuracy and requires no manual intervention. We feel we can place reliance on the ratings to build a robust third-party risk management framework. The solution was new to us, but the scope and accuracy of the data is better than anything I have seen in the market.”

Head of Network Management, Global Custody Bank

“In the past, we only had occasional contact with our IT Security team, who helped to validate the responses to some DDQs [due diligence questionnaires]. Recent regulations and geopolitical events demonstrated to our bank the need to monitor the cyber risk of our post-trade counterparties around the world. Thomas Murray has been instrumental in developing such a programme for us, and in bringing Network Management and IT Security together."

Learn more about our Market Eligibility Due Diligence service

Orbit Diligence

Automate your DDQ and RFI processes for a wide range of use cases, accessing a library of off-the-shelf questionnaires and risk frameworks.

Contact an expert