CPMI-IOSCO PFMI Self-Assessment

In April 2012, CPMI-IOSCO published the Principles for Financial Market infrastructures (PFMIs), a set of 24 high-level principles which set minimum recommended standards for the operations of FMIs (Central Securities Depositories (CSDs), Securities Settlement Systems (SSSs), Central Counterparties (CCPs), Payment Systems (PS) and Trade Repositories (TRs). FMIs are expected to undertake self-assessments to gauge their level of compliance with the PFMIs every 2 years, or when proposing new services, proposing changes to risk controls or when material changes are made to their systems or environment.

Since the completion of the assessments requires significant internal resources, Thomas Murray (TM) assists FMIs by providing a multi-modular support service which ranges from online tools for data collection, through to a full end-to-end solution for completion of an assessment and gap analysis. Since 2013, TM has helped a variety of FMIs to complete new or validate existing self-assessments in markets across the world.

To support the service, TM has also established a programme for monitoring the current status of PFMI completion across the markets it monitors for its clients.

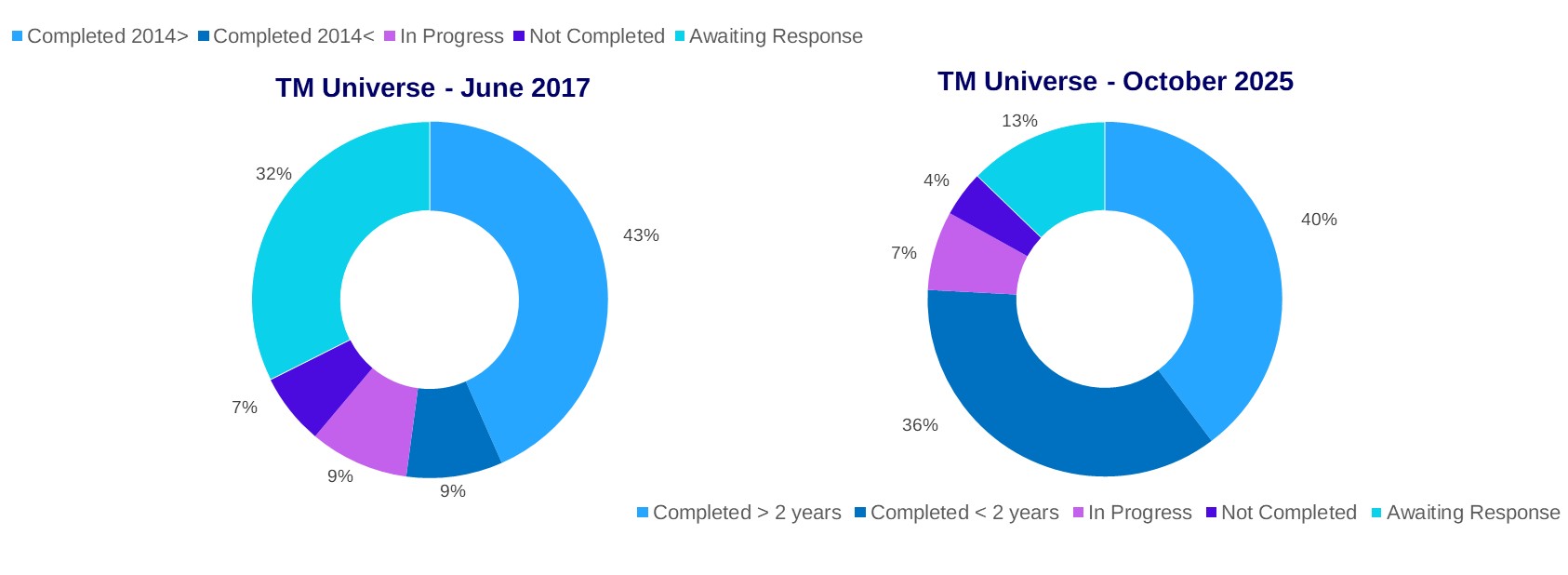

TM launched the PFMI Implementation Matrix (PIM) in July 2017 that displayed the current status of the assessment of each of the 360 FMI’s within the 106 markets that TM currently monitor. The results shown within the above map are updated on a quarterly basis. The parameters this quarter show assessments completed after 2023 and before 2023 as CPMI-IOSCO recommend that FMIs re-assess the PFMIs on an on-going basis every 2 years or when proposing new services, changes to risk controls or when material changes are made to their systems or environment. The charts below display the difference in completion rates of Self-Assessments between the beginning of the monitoring in June 2017 to today: